Bilt Rewards, the innovative rewards program that allows renters to earn points for their monthly payments without added fees, is at it again. This time, Bilt is introducing an industry-first program that rewards members with Bilt points when purchasing a home through an eXp Realty agent.

This new offering awards 1x Bilt points for every $2 of a home's purchase price – meaning a $200,000 home purchase could earn you up to 100,000 Bilt points, which can later be redeemed for travel, experiences, and much more, according to a news release. Given the price of houses these days, it won't be hard to earn a significant sum of Bilt points if taking advantage of this new program. The only real catch here is that in order to earn points when buying a house, you'll need to use an eXP Realty agent for your purchase.

If you're unfamiliar with eXp, they're not your traditional brick-and-mortar realty office, operating on an entirely digital platform without any physical offices at all. But with over 85,000 agents operating in more than 20 countries, odds are you can find an eXp agent in most places where you're looking to buy a home … it just might not be your first choice. This means that if your longtime agent or good friend works for another firm, you'll be left deciding whether working with a new agent is worth a big influx of Bilt points.

To be perfectly clear: Working with an eXp agent doesn't necessarily mean you'll pay more for your house, get poor service, or be limited in your home-buying options. In fact, our travel reporter and flight deal analyst Gunnar Olson used eXp when buying his own home a few years back, and while he had a mostly positive experience, he was surprised to have to pay a $500 “admin fee.” It's an important reminder that as tempting as this new option to earn Bilt points may be, you'll ultimately want the best possible agent representing you when making a big purchase like this.

In a statement, Ankur Jain, founder and CEO of Bilt Rewards, said this new initiative is about more than just earning points: “This is part of our broader mission to make the path to homeownership more accessible and rewarding for our members.”

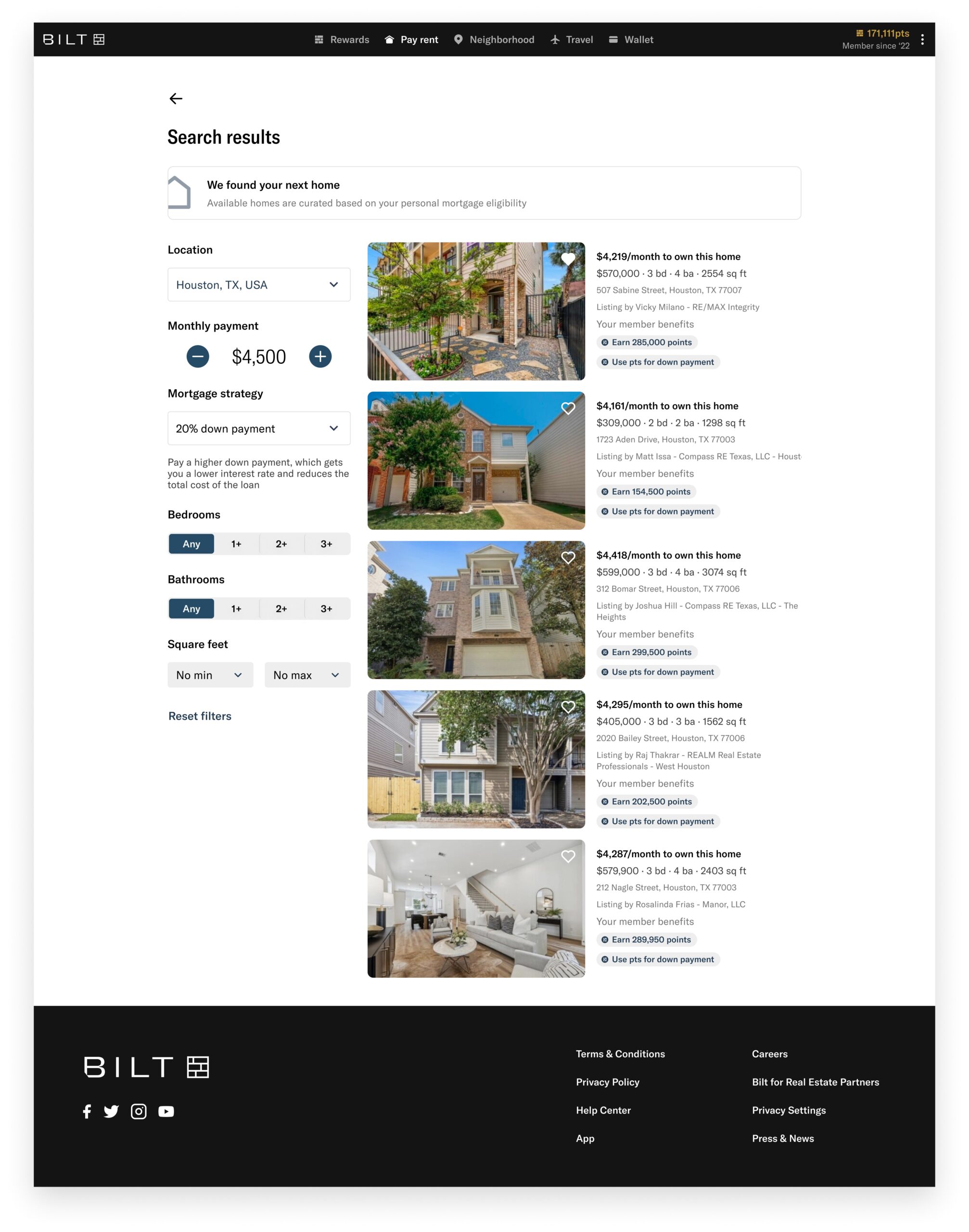

Besides giving Bilt members a new way to earn point, Bilt is also rolling out a new tool for renters to see homes within their budget, which the company hopes will help simplify the home buying process. With this new tool, Bilt converts home listing prices into more transparent estimates of all-in monthly payments that include things like property taxes and insurance – making it easier for renters to compare the monthly cost of homeownership to their current rent.

This tool also factors in Bilt members' financial profile to determine indicative mortgage rates and types, allowing buyers to explore different downpayment scenarios and even have the option to apply Bilt points to the purchase price. Finally, it shows available homes across multiple cities based on monthly payment so you can see how your buying power stacks up in different locations.

How Else You Can Earn Bilt Points

Earning Bilt points when buying a house might be the fastest way to stack them up, but it's not the only option.

Renters can still earn 1x point for every dollar spent on rent payments (up to $100,000 per year) – with no additional transaction fees. If you don't live in a Bilt Rewards Alliance property, you'll need to have the *bilt rewards card* to earn points on your monthly payment. So long as you make at least five purchases each billing period with your card, you’ll earn points on rent and your non-rent purchases as well.

The Bilt Mastercard isn't just for renters though – it's a really good option for your everyday spending as well. With bonus point earning on travel and dining purchases, plus the ability to earn double points on Rent Day it's easy to rack up points in a hurry.

Here's a closer look at everything the card has to offer:

- 1x points per dollar spent on rent in the Bilt Rewards app (up to $100,000 per calendar year)

- 1x points per dollar spent on everyday purchases

- 2x points per dollar spent on travel

- 3x points per dollar spent on dining

- Earn double points on Rent Day (the 1st of the month), up to 10,000 bonus points per month (up to 1,000 points per month effective Oct. 1, 2024)

- 6x points per dollar spent on dining

- 4x points per dollar spent on travel

- 2x points per dollar spent on everyday purchases

- 1x points per dollar spent on rent

- Trip cancellation, interruption, and delay protection

- Auto rental collision damage waiver

- Cell phone insurance

- No foreign transaction fees

- No annual fee!

Learn more about the *Bilt Mastercard*.

How to Use Bilt Points

Just because the points can be fairly difficult to earn doesn't mean they aren't useful – just the opposite. There are many ways to use Bilt points. And once you've got them, they're some of the most valuable points in the world of travel.

The easiest way to use them is to book through the Bilt Rewards travel portal, where each point will be worth 1.25 cents apiece. That means 10,000 Bilt points are worth $125 toward travel.

But you'll get the best value for your Bilt points by transferring points to one of its 14 travel partners, including World of Hyatt, Alaska Airlines, Turkish Airlines Miles & Smiles, United Mileage Plus, and British Airways Avios, among many others.

Just keep in mind that unless you've earned Bilt status, you'll need to transfer a minimum of 2,000 points to get started.

Here's the full list:

| Program | Type | Transfer Ratio |

|---|---|---|

| Aer Lingus Avios | Airline | 1:1 |

| Air France/KLM Flying Blue | Airline | 1:1 |

| Air Canada Aeroplan | Airline | 1:1 |

| Alaska Airlines Mileage Plan | Airline | 1:1 |

| Avianca LifeMiles | Airline | 1:1 |

| British Airways Avios | Airline | 1:1 |

| Cathay Pacific Asia Miles | Airline | 1:1 |

| Emirates Skywards | Airline | 1:1 |

| Iberia Avios | Airline | 1:1 |

| TAP Air Portugal Miles&Go | Airline | 1:1 |

| Turkish Miles & Smiles | Airline | 1:1 |

| United MileagePlus | Airline | 1:1 |

| Virgin Red | Airline | 1:1 |

| Accor | Hotel | 3:2 |

| World of Hyatt | Hotel | 1:1 |

| IHG Hotels | Hotel | 1:1 |

| Marriott Bonvoy | Hotel | 1:1 |

| Hilton Honors | Hotel | 1:1 |

If you prefer to use your points for something other than travel, Bilt recently introduced the ability to “cash out” Bilt Rewards points (at a rate of .55 cents per point) by applying them as a statement credit to the outstanding balance on your Bilt Rewards Card. At approximately a half-cent per point, redeeming them this way represents poor value and should really only be done as a last resort.

Bottom Line

Bilt is already known for allowing renters to earn points on their monthly rent payments, but now Bilt is taking it one step further by allowing members will be able to earn points on their largest lifetime purchase – buying a home.

Bilt members can now earn 1x point for ever $2 of a home's purchase price – but there's a catch of course, you have to use an eXp Realty agent. But this new option means if you purchase a $400,000 house through Bilt, you'll earn a cool 200,000 points in the process.