You've seen the stories about travelers using credit card points and miles to see the world for next to nothing. It sounds like a dream, but is it even real? And where do you begin?

There's plenty of hype and exaggeration out there, but using the right credit cards – and using them responsibly, paying them off in full without going into debt – can absolutely help you travel more for less. But with hundreds of travel rewards credit cards out there, it's overwhelming to pick the right one for you. What cards are worth it and which cards aren't worth the plastic (or metal) they were printed on?

There's no one-size-fits-all answer. The best starter travel credit card for you depends on … well, you: Your spending, your financial situation, your travel patterns, and your goals. But generally speaking, we think the best options for beginners can be boiled down to just a handful of options.

Keep in mind: Credit cards are serious business. You should never apply for a credit card if you're already in debt, and never charge more to a credit card than you can afford to pay off immediately. However many points and miles you can earn, they're not worth it.

Read on for the list of our favorites.

Chase Sapphire Preferred® Card

If you're just getting started with points and miles, your search for a new travel card could very well start and end right here. The *csp* has consistently held its own as one of the best travel rewards credit cards, period. So naturally, it's a great choice for beginners, too.

With the card's current bonus, now is a great time to pick it up: bonus_miles_full

You simply won't find a more valuable bonus on a card with such a modest, $95 annual fee. And while 60,000 points isn't the biggest bonus we've ever seen, Chase points are among the most valuable you could earn from any bank.

But the value of this card goes well beyond the bonus points. With the Sapphire Preferred, you get really strong travel protections when booking flights with your card as well as a primary rental car insurance policy that is second to none.

The beauty of the Chase Ultimate Rewards points you'll earn from the Sapphire Preferred is that there are several great ways to use them. There's a simple and straightforward approach: You can book flights, hotels, rental cars, and more directly through Chase Travel℠. When you use them this way, your points are that much more valuable. Each point is worth 1.25 cents toward your travel.

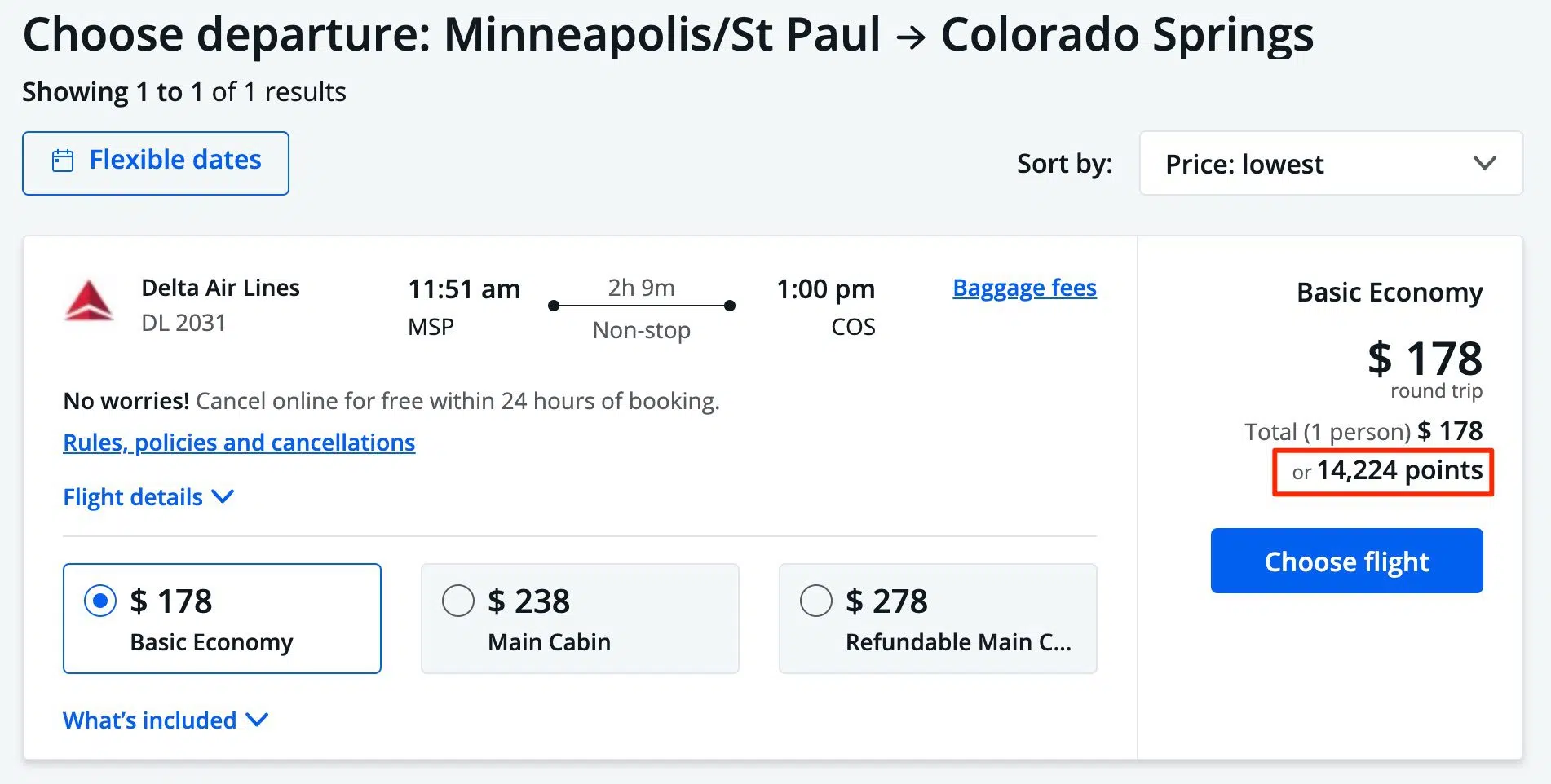

Take this roundtrip flight to Colorado Springs (COS) for example. Though Chase, you can book this $178 fare for 14,224 Ultimate Rewards points.

The Chase Sapphire Preferred is also a great introduction to the versatility of credit card points. You can transfer these points to more than a dozen different airline and hotel partners like United, Virgin Atlantic, Hyatt, and many others. Do it right, and you can make your points go even further towards travel.

The final reason it's one of the best starter credit cards for travelers is a practical one. Chase has some of the most restrictive rules for opening new credit cards. Once you've opened a handful of new cards (from any bank, not just Chase), you'll no longer be approved for a Chase card. This is a big reason why we recommend opening Chase cards first.

Read More: Great Ways to Spend Chase Ultimate Rewards Points

Learn more about the *csp*

Capital One Venture Rewards Credit Card

You'll be hard-pressed to find a better card for anyone just getting started than the longtime-favorite *capone venture*.

This card's annual fee clocks in at a reasonable $95 per year, which is fairly easy to stomach when you consider what you're getting in return.

Most importantly, this card comes with a 75,000-mile bonus for spending $4,000 in the first three months. Since Capital One miles are worth one cent each when used for travel, the current bonus offer is worth at least $750.

Beyond the big bonus, the Capital One Venture Card is one of the cheapest ways to cover the cost of enrolling in either TSA PreCheck or Global Entry, speeding up your path through airport security or customs.

When it comes time to redeem those Capital One miles, you've got options. If you don't want to deal with the hassle of transferring miles to book a free flight or hotel, this is the right card for you. You simply won't find an easier way to use your miles for travel.

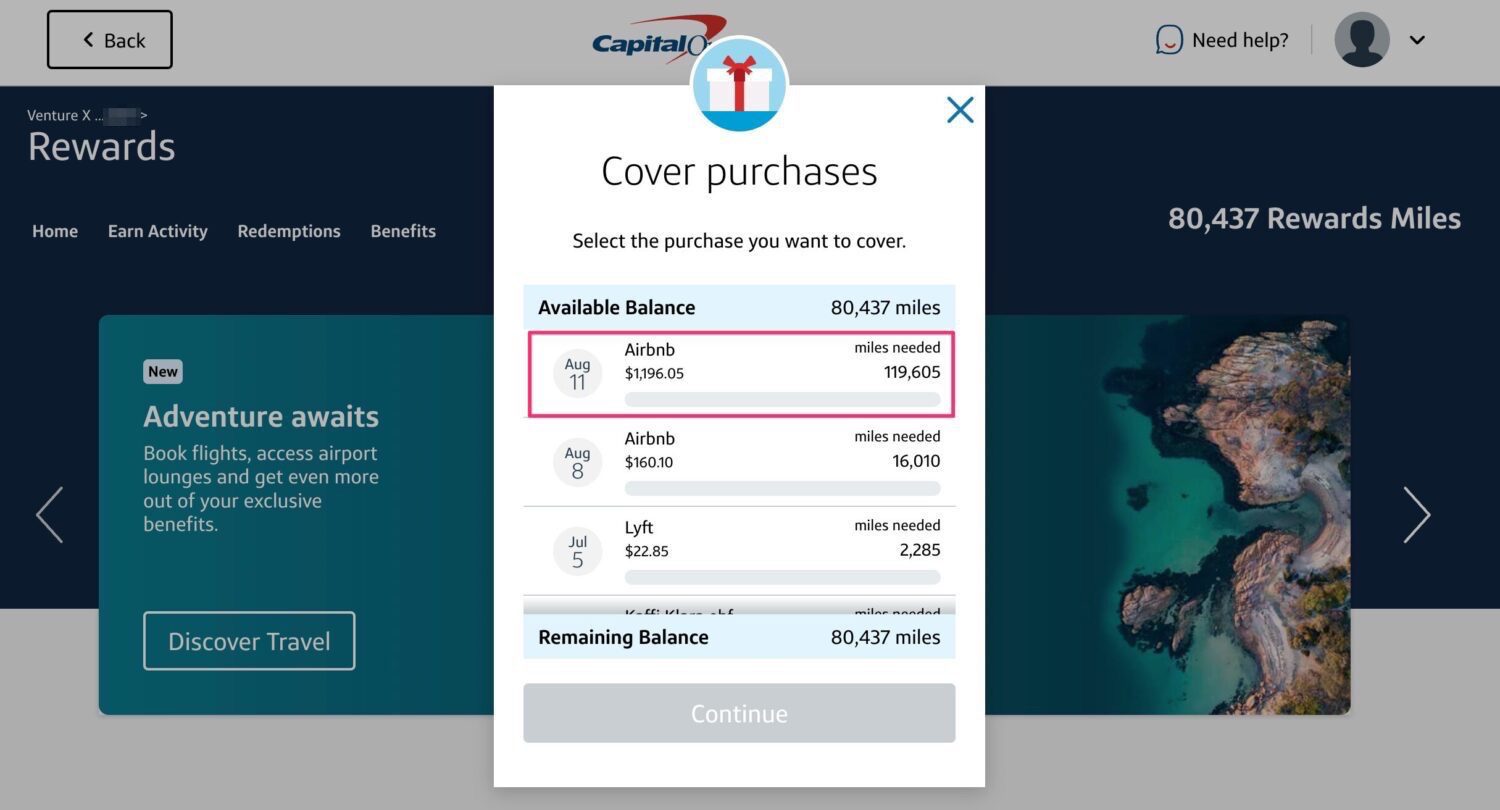

Just book your flight, hotel, rental car, or other travel expense with your Capital One card, then go back and cover the purchase using miles. You can use Capital One miles to cover anything considered a travel purchase, from an Uber ride to an Airbnb stay to even a bucket list golf trip.

Every Capital One mile is worth 1 cent apiece redeeming this way, which means the 75,000-mile bonus gets you at least $750 toward travel. You can also book flights, hotels, and rental cars through the Capital One Travel Portal or send your miles to an impressive array of Capital One transfer partners to get even more value out of them. Some of our favorites include Air France/KLM, Air Canada Aeroplan, British Airways, and Turkish Airlines.

Having the option to go the easy route or take things to the next level through transfer partners is what makes Capital One miles – and the Venture Card – such a great place to get started.

Read More: The Best Ways to Use Capital One Miles

Learn more about the *capone venture*

Capital One Venture X Rewards Credit Card

The *capone venture x* takes everything we've loved for years about the Venture Card … and puts it on steroids. And while the annual fee might scare off some travelers – especially those just getting started with credit cards – it really shouldn't.

Let's start with the bonus, as that's identical to the regular Venture Card. You'll earn 75,000 Capital One Miles after spending $4,000 in the first three months of card membership which can be redeemed for at least $750 towards travel. But you can likely do even better than that by taking advantage of Capital One's expansive list of transfer partners.

The card charges an annual fee of $395 each year, but that number is a bit deceiving. Each and every year you hold the card, you get a $300 travel credit to use in the Capital One Travel Portal for things like flights, hotels, and more. So long as you'd ordinarily spend $300 on travel, the annual fee feels like a much more manageable $95 per year.

But it's even less than that because you also get a 10,000-mile anniversary bonus starting in year two. Those miles are worth at least $100 towards travel. Between the annual Capital One Travel credit and anniversary bonus, it's almost as if Capital One is paying you to get this card. That's why we urge readers not to let the Capital One Venture X annual fee scare them off.

But the benefits don't stop there, either. You'll also get complimentary access to Capital One Lounges and Priority Pass Lounges for you and up to two guests. That includes the recently opened Capital One Lounges in Washington-D.C.-Dulles (IAD) and Denver (DEN).

You'll also get up to $120 in statement credit to cover the cost of TSA PreCheck or Global Entry enrollment, incredible travel protections, and more.

Make sure to check out our story on the full benefits of the Capital One Venture X Card. But seriously: If you plan on spending money on travel each year, this is truly a no-brainer card – as long as you can responsibly meet the minimum spending requirement to earn the big bonus.

Learn more about the *capone venture x*

Chase Freedom® Unlimited and Freedom Flex

OK, so technically these are two different cards. But holding either one of them is a fantastic idea, especially if you already have the Chase Sapphire Preferred Card … and even if you don't.

That's because while these cards are marketed by Chase as no-annual-fee cashback credit cards, you can turn that cash back into Ultimate Rewards points so long as you hold either Chase Sapphire Preferred Card or the top-tier *chase sapphire reserve*.

That's significant because both cards earn bonuses on spending categories that you won't currently earn from the Chase Sapphire cards. While earning the bonus on the Preferred Card is a great start, using these Freedom cards for your everyday spending is a better bet.

On the Chase Freedom Flex℠, you'll earn a $200 bonus (20,000 Chase Ultimate Rewards points) after you spend $500 in the first three months of card membership.

With the *freedom unlimited*, Chase will give you an extra 1.5% cash back (or 1.5x Ultimate Rewards) on everything you buy in your first year (up to $20,000 in purchases). That means you'll be earning a bare minimum of 3% cash back (or 3x Chase Ultimate Rewards) on all purchases (up to $20,000) for a whole year – and it gets even better if your spending falls into a bonus category like dining or drug stores.

Either offer is an incredible deal for cards with no annual fee.

Read More: Chase Freedom Flex vs Freedom Unlimited: Which Version is Right for You

Learn more about the Chase Freedom Flex Card. (for full disclosure, this is not an affiliate link).

Learn more about the *chase freedom unlimited*

Citi Strata Premier℠ Card

Fair or not, the Citi Strata Premier℠ Card is an often-forgotten travel card … but it's actually a pretty good option for anyone just getting started. That's thanks in large part to the current bonus offer: Earn 75,000 ThankYou Points after spending $4,000 in the first three months of account opening. With a relatively low $95 annual fee, that's a pretty outstanding offer.

But what makes this card great for anyone just getting started is that it's one of the most well-rounded cards when it comes to category bonus spending – a true one-size-fits-all option. What do I mean? It earns 3x points per dollar spent at restaurants, supermarkets, gas stations, on air travel, and at hotels. Those are some pretty popular spending categories for most people and will no doubt help rack up points well beyond the initial bonus offer!

When it comes time to use your points you can book travel directly through Citi's travel portal and get 1 cent per point. Or better yet, you can transfer them to one of Citi's nearly 20 different airline and hotel travel partners for even greater value. ThankYou points transfer to all of them on a 1:1 basis (except to Choice Hotels which transfer on an even better 1:2 basis). That means 75,000 ThankYou points can net you 75,000 airline miles or 150,000 Choice points.

That big bonus could be enough to score a fantastic Qsuites business class seat on a one-way flight from the U.S. to the Middle East.

Read More: Citi Strata Premier Card Review: Great Rewards at an Entry-Level Price

All information about the Citi Strata Premier Card has been collected independently by Thrifty Traveler and has not be verified by the issuer.

Learn more about the Citi Strata Premier℠ Card (for full disclosure, this is not an affiliate link).

A Co-Branded Airline Credit Card

Almost everyone has their go-to airline. Whether it's because of the seats, service, or the array of nonstop flights from your home airport, sometimes picking which airline to fly isn't much of a choice at all. Why not get some benefits out of it?

If you often find yourself flying with the same airline and checking luggage, that airline's co-branded credit card is likely a wise decision. Not only will you get free checked luggage just for holding the card, but you will also get priority boarding which can help you beat basic economy fares on airlines like Delta, United, and American.

And unless you're flying on United or JetBlue, you don't even need to pay for the airline ticket with the card to get the free checked luggage benefit. It simply gets attached to your frequent flyer account which allows you the free checked bag … and some other nice perks, like priority boarding and a discount on in-flight purchases.

Considering bags cost at least $35 each way and the annual fee on these cards is typically under $15o, taking two roundtrip flights a year will pretty much pay for your annual fee – assuming you check luggage, of course. And since that benefit often extends to other travelers booked on your reservation, the math works out even better if you often fly with others.

This also allows you to pay for the flight with a card that might be more rewarding or allow you to use other points like the Capital One Venture X Card or the Chase Sapphire Preferred cards listed above. We're strong believers that just because you have an airline card, it doesn't mean you should be spending money on it.

But when it comes to co-branded airline credit cards, timing is critical. A few times per year, airlines like Delta and United roll out bigger bonuses on their credit cards – and that's when you want to strike. If you're a Delta fan, now is a good time to figure out which card is right for you!

See our full list of the top airline credit cards!

Bottom Line

We get it. There's a lot to digest in the world of points and miles and knowing just which card to start with can seem like a full-time job.

Use this list to help you get started and pick one of the best starter credit cards for travelers in 2024.

Why not review United cards?

For the purpose of this article, they are lumped into the section on getting an airline credit card. Generally speaking, you’ll be better off with a card that earns Chase Ultimate Rewards points. These can be transferred directly to United and are simply more valuable.

Hello😀. Your content is super well organized, clear, & efficiently communicated. Thanks!!!

My husband said he saw a card offering 100k miles. I thought I saw it also. Was it an American Express reserve?

Thanks in advance, Lisa

Hi Lisa, thank you! You may be referring to the Amex Platinum 100k offer. Check it out below.

https://thriftytraveler.com/amex-platinum-cardmatch/

I currently possess Chase Saphire Preferred, US Bank Flex Perks, Delta Sky Miles Gold, Sun Country U Fly (using up my miles and will not renew this card), Wells Fargo Rewards, and Wells Fargo Debit card linked to my checking account.

My daughter suggested I upgrade the Saphire Preferred to the Saphire Reserved, but I am unclear whether there is a waiting period between getting Saphire Preferred and Saphire Reserved to still get the initial sign-on bonus. She also suggests eliminating some of the other cards, but I have balance of points/miles on all of these cards.

I am a Thrifty Traveler member. What do you suggest for best use of these cards.

Hi Ric,

If you have the Sapphire Preferred you can upgrade to the Reserve at any time. You just won’t be able to earn the sign-up bonus on the Reserve when you upgrade. Closing some of those other cards will result in losing the points as you mentioned, so make sure to use them up first. Feel free to email me at [email protected] if you have more questions. Happy to help. 🙂