7 Steps to Startup Marketing Strategy [Guide 2024]

Table of contents

Starting a business is an exciting and challenging initiative. A solid marketing strategy is essential for any startup looking to establish a foothold in the market and build a sustainable business.

Take a look at Airbnb, the home-sharing platform that disrupted the hotel industry by successfully marketing its unique value proposition of offering personalized accommodations for travelers. As a result, Airbnb drove growth in the long term.

With the right approach, a startup marketing strategy can turn a great idea into a thriving business.

Table of contents:

- Importance of marketing for startups

- 7 steps to startup marketing strategy:

- Examples of great startup marketing strategies

- Conclusion

Is it possible to run a successful startup without investing in digital marketing?

Running a startup without a digital marketing strategy is nearly impossible nowadays.

Today, most consumers spend a significant amount of their time online, and an increasing number of business transactions are conducted online.

A startup that’s not investing in digital marketing may miss out on a significant portion of the market and potential customers.

Additionally, digital marketing channels such as social media, email marketing, and content marketing can be relatively low cost, but highly effective ways to reach and engage with customers, build a community around the brand, and generate leads and sales.

Furthermore, SEO (Search Engine Optimization) can help startups to improve their visibility on search engines and attract more organic traffic to their website.

With the rise of e-commerce and online transactions, a great startup marketing strategy is essential for startups to establish a competitive edge and stand out in a crowded market. If a startup doesn’t invest in marketing, it will be much harder for them to compete with companies that do.

In short, a startup that doesn’t pay attention to marketing misses many business opportunities.

Monitor online mentions of your startup!

Importance of marketing for startups

Marketing offers startups multiple advantages:

- Boost Brand Awareness: Marketing helps startups build a strong brand and raise awareness about their offerings. This is key for long-term success.

- Expand Reach: Marketing enables startups to connect with a broad audience, enhancing their success potential.

- Target Effectively: With marketing, startups can focus on specific market segments, making their campaigns more effective.

- Drive Leads and Sales: Marketing is essential for generating leads and sales, crucial for startup growth.

- Foster Loyalty: Marketing strategies can turn customers into loyal fans, encouraging repeat business and good reviews.

- Collect Customer Data: Marketing gives startups valuable customer insights for data-driven decision-making.

- Gain a Competitive Edge: Marketing helps startups stand out in a crowded marketplace.

- Save Money: Digital marketing channels are often more cost-effective than traditional ones, allowing startups to reach more people on a smaller budget.

- Establish Online Presence: In today’s digital world, a strong online presence is vital. Marketing helps startups build credibility and trust online.

- Strengthen Customer Relationships: Through engagement, marketing helps startups build lasting relationships with customers, leading to repeat business and valuable feedback.

- Measure and Optimize: Marketing channels offer actionable data. Startups can track metrics, measure ROI, and optimize strategies based on this data.

7 steps to startup marketing strategy

Here are some steps that you need to take to develop a startup marketing plan:

01 Identify the target audience

Knowing your audience is key to an effective marketing strategy. Here’s how to pinpoint who they are:

- Understand your product: Know the features and benefits of what you’re offering. Clarify how it solves a problem for a certain group.

- Do market research: Study your competitors, industry trends, and customer demographics. This gives you a clear picture of who might want your product.

- Spot customer traits: Examine attributes like age, gender, and location to define your ideal customer.

- Form buyer personas: Make fictional profiles of your ideal customers. This guides your messaging and channel choices.

- Examine data: Use your website and social media analytics to understand who’s engaging with your brand and how.

- Test your ideas: Speak to customers or run surveys and focus groups to validate your assumptions.

- Stay updated: As customer behavior changes, adjust your target audience based on new data and insights.

Monitor online mentions of your startup and products!

02 Create USP

Crafting a Unique Selling Proposition (USP) is vital for your startup’s marketing strategy. It’s not just a snappy tagline but the core of what makes your product or service special. Start by pinpointing the unique benefits your product offers. Make sure these benefits solve a specific problem for your target audience.

Next, focus on clarity and simplicity when you communicate this benefit. Your USP should be easy to understand yet compelling enough to grab attention.

Consistency is key. Make sure you can deliver on your USP’s promise every time. This builds trust and keeps customers coming back.

A strong USP also serves as a powerful tool for market positioning. It helps you stand out in a crowded market and draws the eyes of potential customers. Investors also pay attention to a strong USP when considering funding options.

A clear and compelling USP not only differentiates you from competitors but also makes a memorable impression on both customers and investors.

03 Choose marketing goals

Determining your marketing goals is a crucial step in shaping your startup’s marketing strategy. While goals can differ based on your startup’s unique needs, some common objectives include:

- Generate leads: Attract potential customers to your digital platforms. Use methods like social listening, content marketing, and SEO to pull them in.

- Convert leads: Turn your website visitors into paying customers. Craft an effective customer journey with strong calls-to-action and landing pages.

- Scale the business: Grow your startup to a size where it can handle a large customer base and generate substantial revenue.

- Reach profitability: Aim to cover all costs and generate a profit through a sustainable business model.

- Maximize ROI: Ensure your digital marketing efforts pay off. Focus on cost-effective strategies that yield a positive return on investment.

- Engage your community: Build a loyal and active community. This includes customers, prospects, and influencers who will advocate for your brand.

- Boost brand awareness: Make your startup more visible online. Utilize digital channels like social media and online advertising to increase brand recognition.

- Leverage automation: Save time and resources by automating repetitive tasks. Tools for email marketing and social media posting can streamline your operations.

04 Choose digital marketing channels

Some of the most important marketing channels for startups include:

- Social media platforms like Facebook, Instagram, and Twitter help engage with a broad audience and build a community.

- Content marketing through blog posts, videos, and infographics establishes your startup as an industry thought leader and attracts organic website traffic.

- Email marketing nurtures leads and converts them into customers, remaining a potent tool for building relationships.

- SEO improves your website’s visibility on Google, attracting more organic traffic.

- Influencer marketing allows partnerships with social media personalities to reach new audiences and build credibility.

- Paid advertising on platforms like Google Ads and Facebook Ads targets your audience in a cost-effective manner.

- Chatbots and messaging apps like WhatsApp and Messenger offer customer support, improving satisfaction and loyalty.

- Webinars and live streaming on platforms like Zoom and YouTube Live educate and engage customers, helping to build a community.

- Affiliate marketing involves partnerships with other businesses to tap into their customer bases and reach new audiences.

- Virtual events like online conferences and webinars offer a cost-effective way to connect with customers and build your brand. It’s worth noting that the most important channels for a startup will depend on the marketing budget, the specific industry, the audience, and the goals.

It’s worth noting that the most important channels for a startup will depend on the marketing budget, the specific industry, the audience, and the goals.

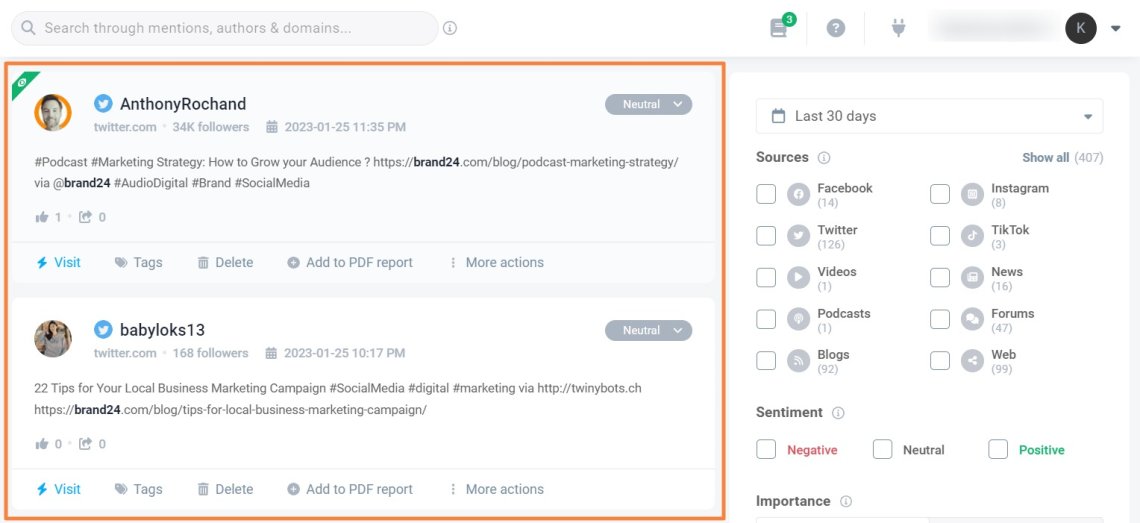

05 Try social listening

Social listening is the process of monitoring and analyzing online conversations and mentions of a brand, product, or industry.

Monitor online mentions of your startup and products!

It will help you:

- Understand how customers feel about their brand, products, or services and use this information to improve customer satisfaction and loyalty.

- Monitor competitors, see what they are doing, what they are saying, and what strategies are working for them so that they can adapt and improve their own startup marketing plan.

- Identify and respond to customer complaints or issues in real-time, improving customer service and preventing negative sentiment from spreading.

- Track the success of hashtags or marketing campaigns by monitoring mentions, likes, shares, and other metrics, and use this information to improve future campaigns.

- Find influencers in the industry who can help you reach a wider audience and increase brand awareness.

- Identify industry trends, such as new technologies or changes in consumer behavior, and adapt their digital marketing efforts accordingly.

Overall, social listening is a powerful tool that can help startups gain a deeper understanding of their customers, competitors, and industry and use this information to improve their startup marketing tactics.

Check: The Best Startup Marketing Tools

06 Build a strong brand

Branding matters for startups. It carves out your identity and sets you apart from rivals. Trust and credibility often follow a strong brand. A well-defined brand also simplifies your messaging. In the end, it helps you win market share and customer loyalty.

To build a strong brand, start with your mission and values. They guide all branding choices and keep your message consistent. Next, research your competitors. Knowing what makes you different helps you stand out. Then, develop a brand voice that aligns with your mission and connects with your audience.

Visuals also play a role. Design a logo, pick a color scheme, and choose your typography. Keep these elements uniform across platforms.

Personality counts too. Create a brand persona that mirrors your mission and appeals to your audience. Apply this persona across all platforms, from your website to social media.

Lastly, keep an eye on your brand’s performance. Adapt based on customer feedback and market trends. This keeps your brand relevant.

07 Measure and analyze results

Measuring and analyzing results is crucial for data-driven marketing. Start by identifying your key performance indicators like website traffic and conversion rates. These metrics gauge the success of your marketing efforts.

Next, gather data from multiple sources. This includes analytics tools and customer feedback. Organize this data for easy analysis. Use techniques like segmentation and A/B testing to dig deep into the data. This helps you spot trends and patterns.

Insights come next. Analyze customer behavior and preferences based on the data. These customer insights guide your marketing decisions. Always test your strategies. Use the data to tweak and improve them. Keep this process ongoing for better results over time.

Don’t keep the findings to yourself. Share them with your team to make collective, informed decisions. Data visualization tools can help. They make your findings easier to understand. Finally, track your progress. Regularly compare key metrics to your goals to spot areas for improvement.

Examples of great startup marketing strategies

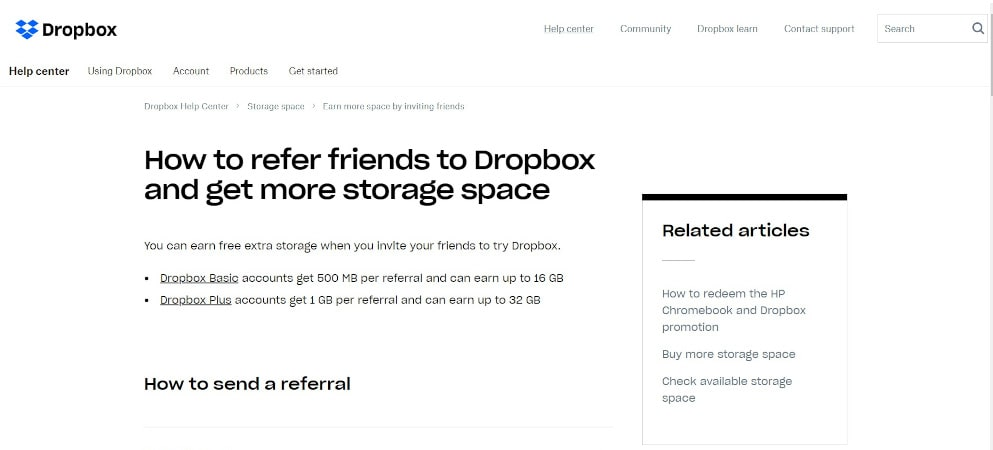

Dropbox

Dropbox used a referral program as a key part of its startup marketing strategy, offering both the referrer and the referred additional storage space for each referral. This not only helped them acquire new users, but also incentivized existing users to promote the product.

Hootsuite

Hootsuite’s early startup marketing plan was based on building a strong social media presence and community through engaging with users on various platforms and creating valuable content. They also leveraged influencer marketing and events to build brand awareness.

Slack

Slack’s early marketing plan relied heavily on content marketing, specifically targeted at the technology industry. They created a blog, The Slack Blog, and produced various content such as ebooks, webinars, and whitepapers.

Airbnb

Airbnb’s marketing strategy has created a sense of community and belonging. They often use user-generated content, such as photos and reviews, to showcase their platform’s unique experiences. They also leverage influencer marketing and events to build brand awareness and community engagement.

Uber

Uber’s early startup marketing plan was based on heavy promotions and discounts to attract customers and then relying on word-of-mouth and social media to sustain growth. They also leveraged partnerships with other companies and events to build brand awareness.

HubSpot

HubSpot’s early startup marketing strategy was based on inbound marketing, which focuses on creating valuable content and experiences that attract customers to the website rather than interrupting them with traditional advertising. They utilized blog, search engine optimization (SEO), and social media to generate leads.

Canva

Canva’s startup marketing strategy is based on providing a free version of its design tool with a paid version for more advanced features. This allowed them to acquire a large user base quickly and then monetize through upgrades and additional features.

Monitor online mentions of your startup and products!

Common mistakes startups make

In the long run, 90% of startups fail. They often make critical errors that can derail their marketing efforts. Understanding these pitfalls can help you avoid them:

Ignoring Word of Mouth

Many startups focus solely on digital marketing and overlook the power of word-of-mouth marketing. They forget that a satisfied customer not only returns but also brings new customers through positive reviews and recommendations.

To harness the power of word of mouth, prioritize customer satisfaction from the start. Happy customers are more likely to recommend your product or service. Implement a referral program that rewards existing customers for bringing in new ones. This creates a win-win situation and encourages organic growth. Networking at industry events and conferences can also help you meet potential customers and partners, further amplifying word-of-mouth marketing.

Overspending on Marketing

It’s easy to get carried away with marketing budgets. However, if your product isn’t up to par, no amount of marketing will save you.

Balance your budget between product development and marketing. A quality product will naturally attract more customers and make your marketing efforts more effective. Consider lean marketing strategies that offer a high ROI, such as content marketing or social media ads targeted to your specific audience.

Lack of Clear Goals

Without specific, measurable objectives, marketing efforts can become unfocused and ineffective, wasting both time and money.

Instead of wandering in the dark, always set clear, measurable goals for your marketing campaigns. Use key performance indicators (KPIs) to track your progress. This will not only guide your marketing strategies but also provide a clear metric for success or areas for improvement.

Targeting the Wrong Audience

Startups sometimes misidentify their core audience, leading to ineffective marketing campaigns and wasted resources.

As a solution, conduct thorough market research to identify your target audience accurately. Create buyer personas to understand their needs, preferences, and pain points. Tailor your marketing strategies to address these specific characteristics. Regularly update your understanding of your audience as your business grows and evolves.

Ignoring Analytics

Data analytics can offer deep insights into customer behavior and data-driven marketing campaigns. Ignoring this data means missing out on valuable opportunities to refine your marketing strategies.

To fix this, invest in analytics tools like Brand24 that can help you track key performance indicators relevant to your business goals. Regularly review this data to understand what’s working and what needs adjustment. Make data-driven decisions to optimize your marketing efforts continually.

Sign up for a free trial!

Inconsistent Branding

Inconsistent branding can confuse your audience and dilute your brand’s impact. This can happen through varied messaging, visual elements, or even the tone of communication.

To combat this, develop a comprehensive brand guide that outlines your brand’s mission, voice, visual elements, and overall personality. Ensure that all marketing materials, across all platforms, adhere to this guide. Consistency in branding not only strengthens your brand but also builds trust with your audience.

Neglecting SEO

SEO is key for online visibility. Neglecting it can lead to low website traffic and poor customer engagement.

Invest in an SEO strategy that includes keyword research, quality content creation, and backlinking. Monitor your website’s performance and make necessary adjustments to stay competitive in search rankings. SEO is a long-term investment but essential for sustained online visibility.

Failing to Adapt

The digital landscape changes rapidly. If you don’t adapt to new platforms or technologies, your startup risks becoming obsolete.

If you don’t want to be outpaced, stay updated on industry trends, emerging technologies, and shifts in consumer behavior. Be willing to pivot your marketing strategies to align with these changes. Regular training and workshops can keep your team agile and open to new approaches.

Overlooking Mobile Users

Smartphone use is on the rise. Failing to optimize for mobile can alienate a significant portion of your audience.

Ensure your website is mobile-friendly and consider developing a mobile app if it adds value to your customer experience. Optimize all marketing materials, including emails and ads, for mobile viewing. Mobile optimization is no longer optional. It’s a necessity.

Poor Customer Service

Bad customer service can tarnish your brand’s reputation. Always strive for excellence in customer interactions.

Invest in customer service training for your team and implement customer relationship management (CRM) software to track interactions and feedback. Quick response times and personalized service can turn a dissatisfied customer into a loyal one.

Lack of Content Strategy

Content is crucial in digital marketing, but without a coherent strategy, you miss out on engagement opportunities.

Develop a content calendar that aligns with your brand’s goals and audience needs. Use a mix of blogs, videos, and social media posts to engage your audience. Regularly review analytics to understand what content resonates and adjust your strategy accordingly.

Overreliance on Paid Advertising

While paid ads can boost visibility, relying solely on them can be unsustainable in the long run.

Balance your marketing mix by investing in organic strategies like SEO, content marketing, and social media engagement. These strategies often offer a better return on investment over time and can complement your paid campaigns.

Conclusion

A startup marketing strategy is a vital component of the success of any new business. It is the foundation that helps startups to raise brand awareness, generate leads and acquire customers.

To build a solid startup marketing plan, you need to:

- Understand your target audience

- Define your unique value proposition

- Identify key performance indicators (KPIs)

- Utilize growth hacking techniques

- Measure and analyze efforts

Want to boost your marketing tactics? Try Brand24 for free!

FAQ

What is startup marketing?

Startup marketing refers to the unique set of strategies and tactics used by early-stage companies to promote their products or services, grow their customer base, and establish a strong brand presence in the market. Given that startups often operate under resource constraints, their marketing approach must be highly creative, agile, and cost-effective.

Startup marketing might involve leveraging various channels and tactics, including but not limited to, search engine optimization (SEO), content marketing, social media marketing, influencer marketing, and public relations. A well-planned marketing campaign can drive awareness and lead to the growth of the startup business.

What are the stages of marketing for a startup?

Marketing for a startup generally follows these stages:

- Market Research: This is the initial phase where you identify your target audience, understand their needs and preferences, and analyze your competition. The information gathered here informs your entire marketing strategy.

- Product-Market Fit: In this stage, you align your product or service with identified market needs. You may need to tweak your offering based on customer feedback to ensure it provides value to your target audience.

- Pre-Launch Marketing: This is when you start to create buzz around your product or service. You can do this through a variety of marketing channels such as email newsletters, social media, and influencer partnerships.

- Launch: The launch is when you officially introduce your product or service to the market. This might involve a major marketing push, including creating ads for various channels to reach a larger audience.

- Growth and Retention: After the launch, the focus shifts to attracting new customers and retaining existing customers. This can be achieved through tactics like content marketing, search engine optimization (SEO), social media marketing, and paid ads.

- Expansion: Once you’ve secured a strong customer base and steady revenue, you might consider expanding into new markets or developing new products or services.

Each of these stages requires a different marketing approach, and the tactics used will continually evolve based on the startup’s growth and market response.

How do I find startup customers?

Finding customers for your startup involves a combination of precise targeting and proactive outreach. Here’s how you can do it:

- Understand Your Target Market: Conducting market research will help you identify your ideal customers, understand their needs, preferences, and the channels they frequent.

- Leverage Social Media Channels: Having a robust presence on social media is crucial. Engage with your audience through consistent and valuable content, participate in relevant discussions, and promote your product or service.

- Networking and Events: Attend industry events, trade shows, and networking gatherings. This allows you to connect with potential customers, partners, and even mentors. Online webinars and virtual conferences can also be valuable.

- Engage Early Adopters: Early adopters are those who are keen to try new products or services and can provide invaluable feedback. They can become advocates for your brand, helping to spread the word.

- Referral Marketing: Encourage your satisfied customers to refer others to your business. You can incentivize this through a referral program that rewards customers for every successful referral.

- Partnerships: Collaborate with businesses that complement your offering. Their customers could potentially be interested in your product or service too.

How to do product marketing at a startup?

Product marketing at a startup is a crucial process to successfully introduce your product to the market and build customer engagement. Here are steps to execute it effectively:

- Know Your Product and Market: It starts with an in-depth understanding of your product’s unique features, benefits, and the problem it solves. Concurrently, conduct market research to understand your target audience and competitors.

- Develop a Positioning Statement: Define the unique value your product brings to the market. This positioning statement will be central to all your communication and marketing strategies.

- Define Your Marketing Strategy: Build a successful marketing strategy to reach your target audience. This might involve content marketing, social media marketing, email campaigns, SEO, PPC advertising, and influencer partnerships.

- Create a Launch Plan: This involves choosing a launch date, coordinating marketing activities leading up to the launch, and planning any launch events or promotions.

- Execute Your Marketing Strategy: Implement the strategies outlined in your marketing plan. This could include creating and distributing content, running social media campaigns, or launching your email marketing campaign.

- Monitor and Adjust: Regularly review your strategy’s performance using the right metrics such as customer acquisition cost, conversion rate, or customer lifetime value. Use these insights to adjust your strategy and ensure the best return on investment.

Remember, while product marketing at a startup can be challenging, it offers the opportunity to create innovative campaigns that genuinely resonate with your audience. A successful marketing strategy takes time, experimentation, and adaptability.