IHG and Chase offer a trio of co-branded credit cards but one card is tailored specifically to business travelers: The *IHG Business*.

This card provides an avenue for road warriors – and occasional business travelers – to earn bonus IHG points on stays and get valuable perks like elite status, a valuable free night certificate every year upon renewal, a fourth-night free benefit on award stays, and more.

Plus, new cardmembers can currently earn a big bonus: bonus_miles_full. Whether you've got a full-fledged business or just a side hustle, you could easily be eligible to open a business credit card – and with this bonus, you might want to.

While IHG is perhaps best known for basic hotel brands like Holiday Inn or Crowne Plaza, there are also excellent Intercontinental properties, boutique Kimpton hotels, and even Six Senses resorts to choose from as the hotel chain has breathed some new life into its IHG Rewards program.

Let's take a closer look at all this card has to offer, beyond the eye-opening welcome offer.

Full Benefits of the IHG Premier Business Card Details

- Welcome Offer: bonus_miles_full

- Earn 10x IHG points on all IHG Hotels & Resorts purchases

- Earn 5x IHG points on other travel, gas, dining, and select business services (including social media and search engine advertising and office supply stores) purchases

- Earn 3x IHG points on all other purchases

- Automatic IHG Platinum Elite status

- 4th Night Free Benefit: Redeem points for four consecutive nights and only pay for three nights

- Free night award certificate starting your second year with the card, capped at properties that cost up to 40,000 points per night (though you can add your own points to book more expensive hotels)

- Get up to a $120 Credit for Global Entry or TSA PreCheck

- $50 of United TravelBank cash each calendar year when you link your United and IHG accounts

- Annual Fee: $99, which is not waived for the first year

Learn more about the *IHG Business*.

Who Is This Offer Good For?

The *IHG Business* offers a solid list of benefits for a card with an annual fee under $100. With hotel rates on the rise, the free night certificate alone (you get this starting in your second full year with the card) could easily make it a keeper for many travelers.

It's a compelling card for any small business owner with an eye for IHG properties. It's an especially great fit for road warriors who stay in hotels Monday through Friday, traveling to some off-the-beaten-path towns along the way. But it could also make sense for the occasional business traveler who just wants to get the best value out of their nights on the road, while enjoying some additional perks.

Just remember: Credit cards are serious business. Whether it's a personal card or for a small business, like this one, you should never apply for a credit card unless you can afford to pay off every dime you charge – no matter how big the bonus is.

Using IHG Points

While 140,000 points sounds like a massive bonus, keep in mind: Points and miles are not created equally. These points are only good for hotel stays at IHG properties, which means they aren't worth nearly as much as transferrable points like Chase Ultimate Rewards, Capital One miles, or American Express Membership Rewards.

That said, IHG points are far from worthless. Given the reasonable rates you can often find to book free night stays, this bonus of up to 140,000 points is a stellar offer.

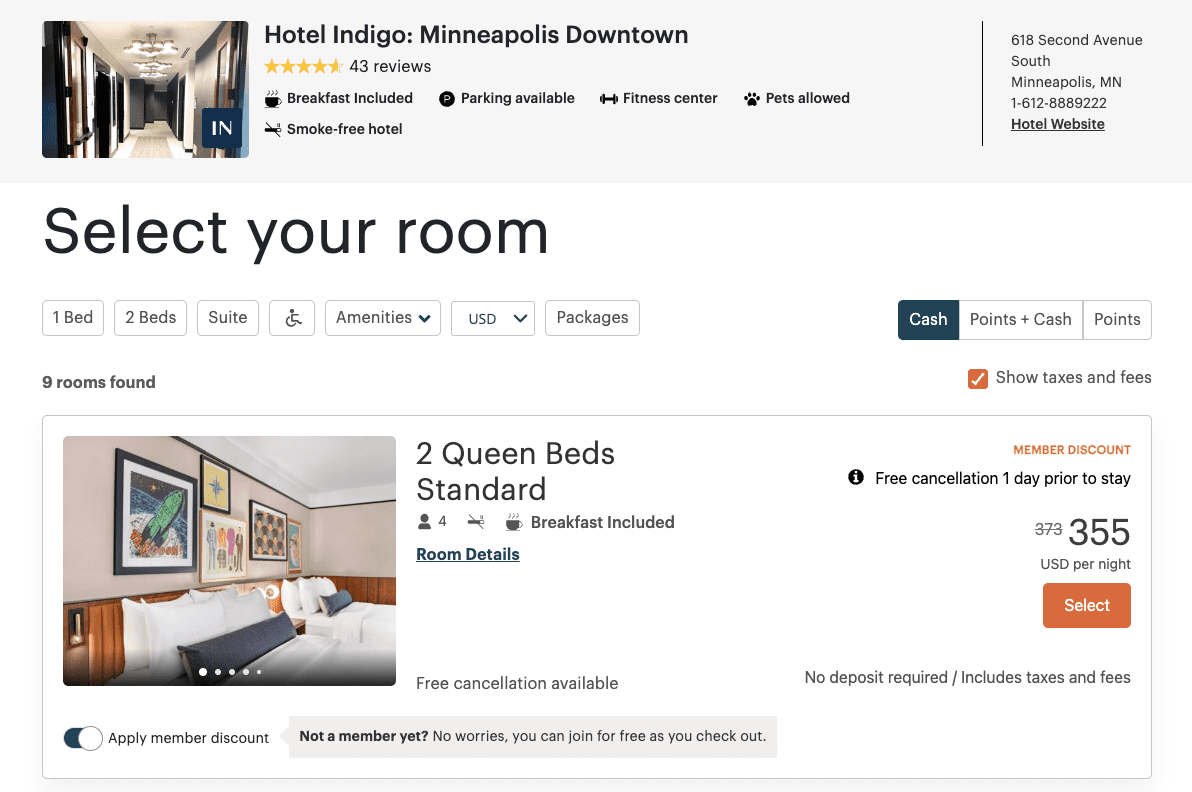

Looking at a random two-night stay for the Hotel Indigo in downtown Minneapolis, the total cost with taxes and fees would be just over $355 per night.

Read our review of the Hotel Indigo in downtown Minneapolis for an idea of how you can put this big welcome offer to use!

But you could book that exact same two-night stay for just 45,000 IHG points per night.

Consider this: After spending the $4,000 required to earn the card's full bonus, you'd have at least 152,000 IHG points. With IHG's fourth-night-free benefit factored in, that's enough to cover four nights at this property that would otherwise cost you over $1,400 if paying cash.

Maybe you're looking for something a little more tropical than Minneapolis – Hawaii surely fits the bill. With this card's sign-up bonus, you'd have enough points for a five-night stay on Honolulu's famous Waikiki Beach.

Here's how it works: If you used cash for a stay at the Holiday Inn Express Waikiki, it would cost $255 per night and more than $1,200 in total. Yikes!

But instead, you could book that exact same hotel for just 35,750 IHG points per night.

That's just a couple of examples of how to use your points – and you could easily get more (or less) value out of them depending where you stay. But at the end of the day, there is definitely value to be had within the IHG program and with this bonus.

Read more: What are points and miles worth?

Are You Eligible to Get the IHG Business Card?

Before you apply, it's important to make sure you're eligible for both the card and the welcome offer.

Since it's a business card, you may have assumed you aren't eligible … but don't rule it out just yet. Many Americans have what the banks would consider a small business and don't even realize it.

Do you have any income from freelance work, or plans to start freelance work? You have a business. Have you ever sold an item on eBay, Facebook Marketplace, Etsy, or other platforms, or have plans to do so in the future? You have a business.

If you're still trying to decide whether you qualify for business cards, read this first!

After that, there are other factors to consider. And the Chase 5/24 rule is among the most important restrictions for any Chase card, including this one. Basically, Chase won’t accept applications if you’ve opened five or more cards in the last 24 months from any bank – not just Chase. With business cards, that same rule applies … kind of.

For starters, you will need to be under the 5/24 limit in order to get approved for the Chase IHG Rewards Business Card … but that approval won't add to your 5/24 count. So if you've opened three or four credit cards in the last two years, it might be the perfect time to apply for one of these cards. That way, it won’t hinder any applications for other future Chase cards.

But Chase can be very stingy with approvals for business credit cards, so be prepared to provide business paperwork and answer a lot of questions.

Read our master guide to credit card applications!

Bottom Line

Chase is out with a big, 140,000-point bonus offer on the *IHG Business* . For many travelers, this card is worth having for the long-haul thanks to its lengthy list of benefits and a free anniversary night.

Learn more about the *IHG Business*.

Featured image courtesy of IHG Hotels & Resorts

MSGA! Make SUBs Great Again! Chase/IHG continuing the trend of watering down subs…last spring the offer for this card was a straight 175k pts after $4k spend. Although amex can be criticized about much, their SUBs continue to remain very enticing and competitive.

Hi,

I am under the 5/24 limit.

I have personal IHG Rewards Club C.C.($49AMF).

Do I still have a chance to be approved?

Hi Sandy,

Yes! You can hold both a personal IHG card and a business IHG card. Assuming you meet all the other application requirements you should be good to go.

Thanks for reading!