In the hierarchy of points and miles that can help fuel your travels, American Express Membership Rewards® points are arguably at – or certainly near – the top of the list.

From booking flights and hotels through Amex Travel to the ability to send points directly to more than 20 different airlines and hotels that are Amex transfer partners, these points offer almost unparalleled flexibility and value to travelers looking to use points to fly or stay somewhere free – or nearly free. And despite an all-out arms race with other major banks like Chase, Citi, and even Capital One, American Express has continually evolved and made Membership Rewards points – and the credit cards that earn them – even more valuable over the years.

We’ll walk you through everything you need to know about the Amex Membership Rewards points program, including how to earn points, use them for maximum value, and all the little nuances you should be aware of along the way.

- How to Earn American Express Membership Rewards Points

- What are Membership Rewards Points Worth?

- How to Use Amex Membership Rewards Points

- Important Restrictions on Getting American Express Credit Cards

- Do Amex Membership Rewards Points Expire?

- Can You Transfer Membership Rewards Points to Other Members?

How to Earn American Express Membership Rewards Points

By far the easiest and best way to earn Amex Membership Rewards points is by taking advantage of the welcome bonus offers and continuing to spend on the suite of credit cards that earn American Express Membership Rewards points.

Keep in mind: This is specifically about Amex's collection of independent credit cards, not co-branded Amex cards like the suite of Delta SkyMiles American Credit Cards or even Hilton Honors American Express cards. Those cards only earn Delta SkyMiles or Hilton Honors points, respectively.

Instead, you want the far more versatile Membership Rewards cards. And whether you are looking for a personal or business card, there is no shortage of cards that earn these valuable points.

Credit Cards That Earn American Express Membership Rewards Points

The Platinum Card® from American Express

The top dog when it comes to credit cards that earn American Express Membership Rewards points is without question *amex platinum*. The card provides an exhaustive list of both travel and lifestyle benefits which push the card's annual fee to $695 each year (see rates & fees).

Here;'s the full list of the card's benefits.

- Earn 80,000 Membership Rewards Points after you spend $8,000 on purchases in your first six months of card membership – but check to see if you qualify for a 150,000-point bonus via CardMatch!

- Earn 5x Membership Rewards Points for flights booked directly with airlines or with American Express Travel (up to $500,000 spent each year).

- Earn 5x Membership Rewards Points on prepaid hotels booked with American Express Travel.

- Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel on a minimum two-night stay when you pay with your Platinum Card.

- $240 Digital Entertainment Credit: Get up to $20 in statement credits each month when you pay for eligible purchases with the Platinum Card at your choice of one or more of the following providers: Peacock, The Wall Street Journal, and The New York Times.

- Access to 40+ Centurion Lounge and Centurion Studio locations worldwide, plus other lounges in the Amex Global Lounge Collection like Airspace Lounges, Plaza Premium, and others

- Get access to the Delta Sky Club when you are flying with Delta Air Lines.

- Get a Priority Pass Select Membership for access to 1,000 plus more lounges worldwide

- $200 Airline Fee Credit: Get up to $200 in statement credits per calendar year in baggage fees and more at one qualifying airline.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually.

- $199 CLEAR® Plus Credit: Use your Card and get up to $199 back per year on your CLEAR® Plus membership.

- $695 Annual Fee (see rates & fees)

Learn more about *amex platinum*.

Own a small business, or are you eligible to open a small business credit card? American Express also has a business version of the Platinum Card. *biz platinum* offers many of the same benefits as the personal card, but also has a number of small business-focused benefits. The annual fee is $695 each year (see rates & fees).

Learn more about *biz platinum*

American Express® Gold Card

Next on the list is the American Express® Gold Card. While the card doesn't offer nearly as many benefits as the Platinum Card, it's a great mix of value and a much more palatable annual fee of only $325 (see rates & fees). You won't find a better all-around credit card to keep piling up points on your everyday spending.

Here's the full list of the card's benefits.

- Welcome Offer: bonus_miles_full

- Earn4x points per dollar spent at restaurants worldwide, including takeout and delivery in the U.S. (now capped up to $50,000 per year

- Earn 4x points per dollar spent at U.S. supermarkets (up to $25,000 per year)

- Earn 3x points per dollar spent directly with airlines or at amextravel.com

- Earn 2x points per dollar spent on prepaid hotels, car rentals, and cruises at amextravel.com

- Earn 1x point per dollar spent on other eligible purchases

- $120 Dining Credit: Enroll and earn up to $10 in statement credits monthly (up to $120 annually) when you pay with the Gold Card at Five Guys, Grubhub, The Cheesecake Factory®, wine.com, and Goldbelly

- $120 Uber Cash: Add the U.S. Consumer Gold Card to your Uber account to receive $10 in monthly Uber Cash credits (up to $120 annually) towards Uber Eats or Uber Rides. Effective Nov. 8, 2024, an Amex Card must be selected as the payment method for your Uber or Uber Eats transaction to redeem the Amex Uber Cash benefit.

- $100 Resy Credit: Get up to $50 in semi-annual statement credits ($100 per year) after you enroll and pay with the Gold Card at U.S. Resy restaurants or on other eligible Resy purchases.

- $84 Dunkin' Credit: Get up to $7 per month ($84 per year) in statement credits after you enroll and pay with the Gold Card.

- No foreign transaction fees

- Annual fee: $325 (see rates and fees).

Learn more about the *amex gold*

Like the Platinum Card, there is also has a business version of the Gold Card. The *biz gold* offers many of the same benefits as the personal card, but also has a number of small business-focused benefits.

But the annual fee on the Business Gold Card is higher than the personal Gold card at $375 each year (see rates & fees).

Learn more about the *biz gold*.

American Express® Green Card

Then there is the American Express® Green Card. Once again, the benefits are not as fruitful as they are on either the Platinum or the Gold Card. But with fewer benefits comes a smaller annual fee of only annual_fees each year.

See below for a full listing of the card's benefits.

- bonus_miles_full

- Earn 3x Membership Rewards Points at Restaurants, including takeout and delivery.

- Earn 3x Membership Rewards Points on transit, including trains, buses, ferries, subway, and more.

- Earn 3x Membership Rewards Points on travel, including airfare, hotels, cruises, tours, car rentals, and more.

- $199 CLEAR® Plus Credit: Use your card and get up to $199 back per year on your CLEAR® Plus membership.

- $100 Credit for Lounge Access: Use your card to purchase lounge access through LoungeBuddy and receive up to $100 in statement credits each year.

- annual_fees Annual Fee

Read More: Amex Green, Gold & Platinum Cards: Which is Right for You?

Learn more about the American Express® Green Card (for full disclosure, this is not an affiliate link).

The Blue Business® Plus Credit Card from American Express

Perhaps one of the most underrated credit cards out there is *blue biz plus*. This card earns 2x Membership Rewards points on all purchases on up to $50,000 spent each calendar year (then 1x). The best part? The Blue Business Plus card does not have an annual fee (see rates & fees).

- Welcome Offer: *Blue Biz Plus Bonus*

- Earn 2x Membership Rewards points on the first $50,000 in purchases each year

- Earn 1x Membership Rewards points after the first $50,000 spent each year

- Buy above your credit limit with Expanded Buying Power. The amount you can spend above your credit limit adjusts with your use of the card, your payment history, credit record, and other factors.

- No annual fee (see rates & fees)

Learn more about *blue biz plus*.

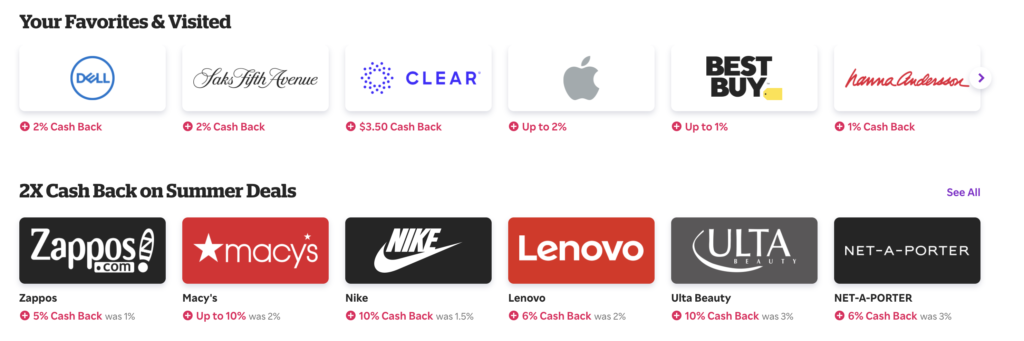

Earn Membership Rewards Points Shopping with Rakuten

Unlike Chase Ultimate Rewards which has its own Shop Through Chase shopping portal, American Express doesn't have its own shopping portal that allows you to earn bonus Membership Rewards points for shopping online. But there's a great workaround to pile up more points on your shopping.

Back in 2019, American Express teamed up with Rakuten to provide an option to earn Membership Rewards points instead of cashback for clicking through the Rakuten portal on your way to make an online purchase.

Rakuten is among the best online shopping portals out there. It lets you earn additional cashback – or Membership Rewards – by first clicking through Rakuten on the way to the website of thousands of retailers. It occasionally offers huge signup bonuses for first-time users as well as elevated bonuses at hundreds of retailers.

If you elect to earn Membership Rewards points instead of cashback, you'll earn one Membership Rewards point for each percentage point of cashback offered. So let's say you're shopping at the Apple Store, where you'd typically earn 2% cashback. That'd be 2x Membership Rewards points per dollar instead.

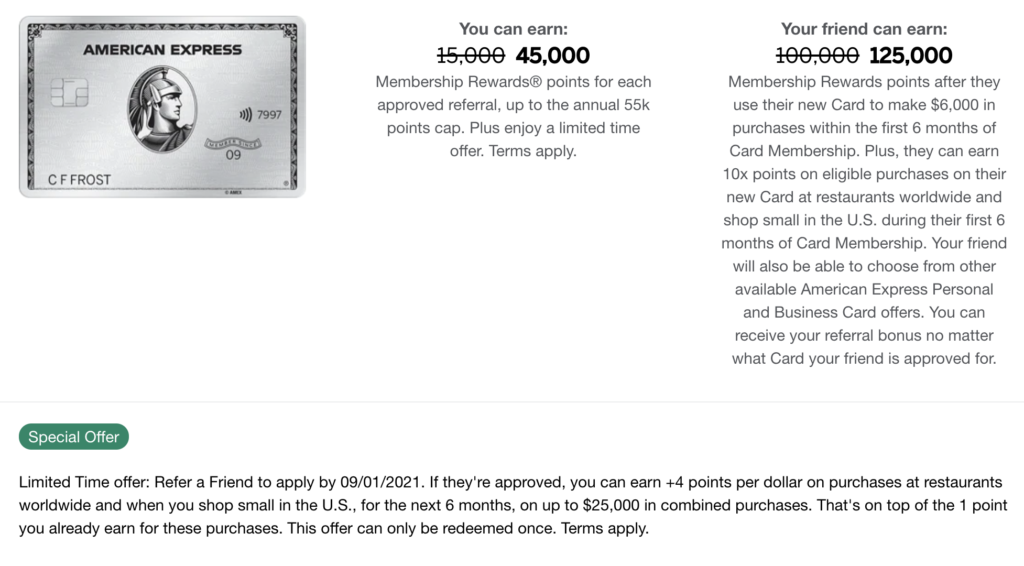

Earn Membership Rewards Through Personal Referrals

Another great opportunity to earn Membership Rewards points comes from referring your card to friends and family members. Many times, the offers you can send a friend or family member are better than the offers that are publicly available, making it a win-win for both parties.

Just beware, American Express started taxing points earned through personal referrals back in 2019. Each card will allow you to earn 55,000 points each year through personal referrals, and Amex will tax those at one cent each. That means, come tax time, you would receive a 1099-MISC form for $550 if you max out on those referrals.

What are Membership Rewards Points Worth?

American Express does not officially publish a valuation. Exactly what these points are worth is in the eye of beholder – and how they put them to use.

On the extreme conservative side, American Express Membership Rewards points are worth at least one cent each. So if you had 100,000 points, for example, they would be worth at least $1,000 towards travel.

But thanks to the stable of American Express Membership Rewards travel transfer partners, you can do much, much better than that. In fact, some of the best transfer partners will allow you to get two cents – or much more – for each of your points. It just depends on how you use them.

So let's dive into the basics on how to use Membership Rewards.

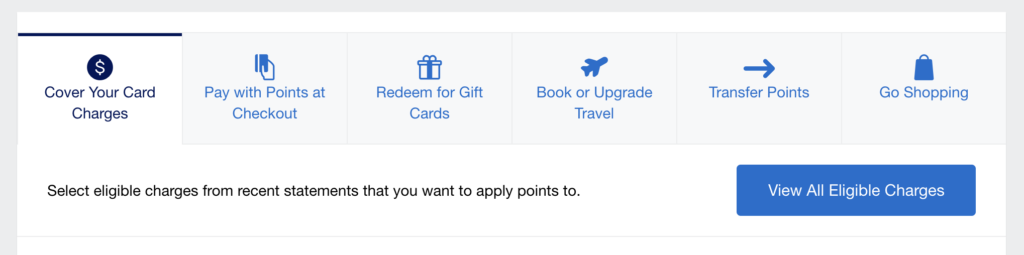

How to Use Amex Membership Rewards Points

When it comes to using Membership Rewards points, you'll have a handful of options at your disposal. But we're a travel website, so let's get the obvious out of the way: Using them for travel experiences will give you the best return on them by far.

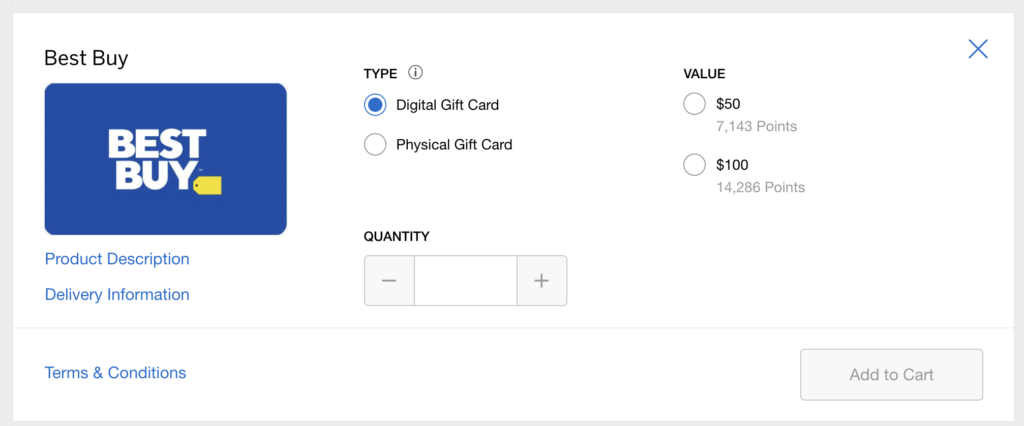

For example, while it is possible to redeem your points for charges, or even gift cards, many of those redemptions are at a very poor value in comparison. When it comes to gift cards, the value of your points will change depending on the gift card you are looking at.

For example, you can redeem points for a Home Depot gift card, getting one cent apiece for your points. That means 2,500 points would get you a $25 gift card.

But that value drops dramatically if you are looking at a Best Buy gift card.

So here's the bottom line: Use Membership Rewards for travel. Doing so will simply give you the best value out of your points.

When you are using them for travel, you have a few different options.

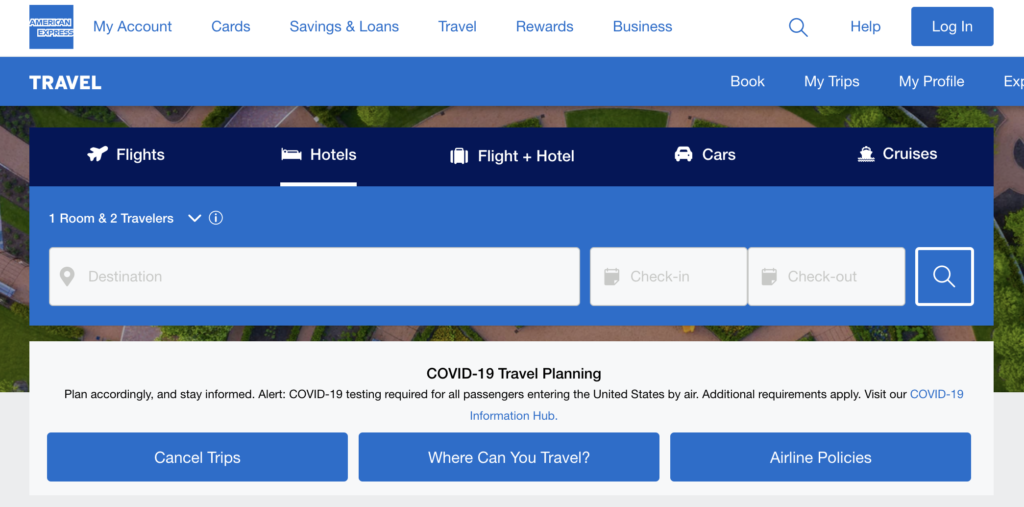

Book Travel Through the Amex Travel Portal

When booking travel with Membership Rewards points, the first and perhaps easiest is to use the Amex Travel portal. Through Amex travel, you'll have the ability to book flights, hotels, rental cars, and even cruises.

When you do, your points will be worth one cent each. That means 100,000 Membership Rewards points would get you $1,000 towards travel.

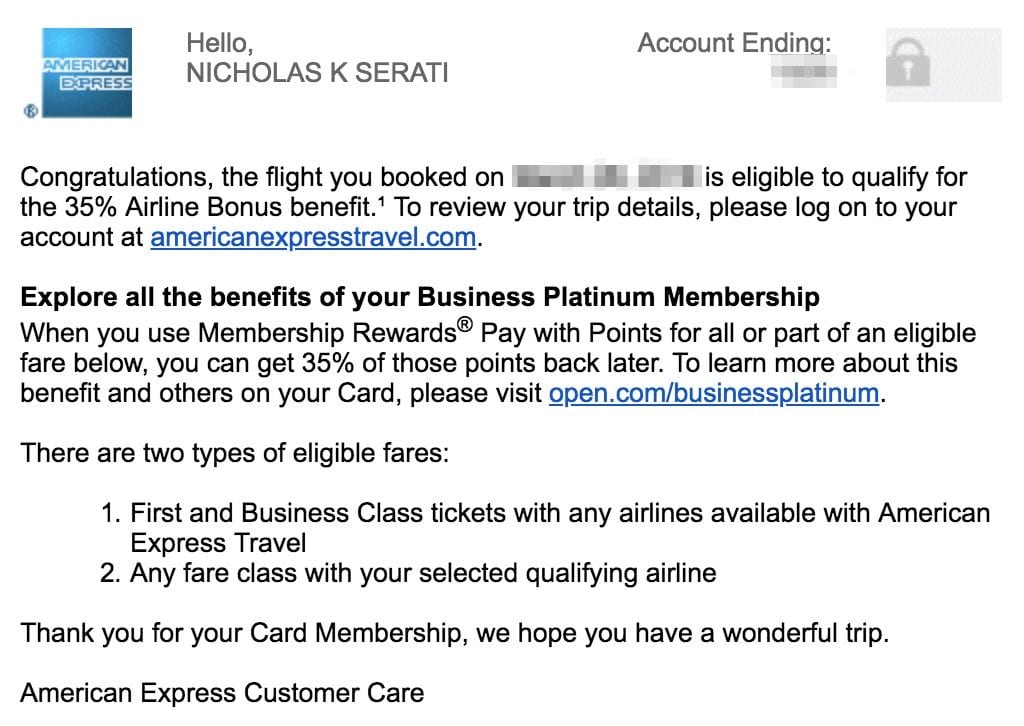

That's true unless you hold either the Business Platinum Card® from American Express or the *biz gold*. If you hold the Business Platinum Card, you'll get a 35% points rebate when you book economy flights on one selected airline each year – or on any airline if you book a business or first class ticket. You can earn up to 1,000,000 points each year through these rebates.

With the Business Gold Card, you'll get a 25% points rebate when you book economy flights on one selected airline each year – or on any airline flying first or business class. You can earn up to 250,000 points back each year.

Read more: Our Favorite Benefit of the Amex Business Platinum Card.

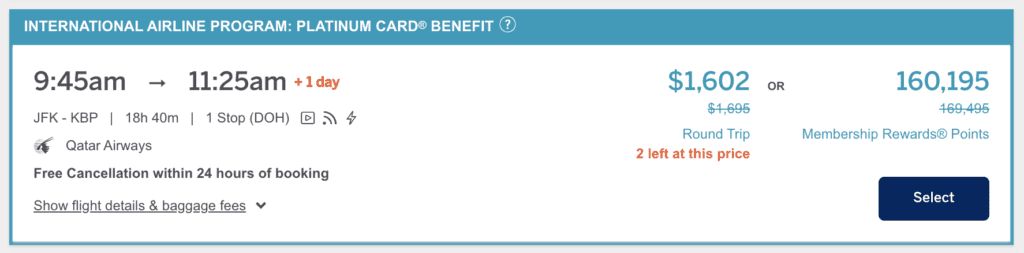

Amex International Airline Program

Another feature to be aware of with Amex Travel is the Amex International Airline Program (IAP). It's an exclusive benefit available to both Platinum and Business Platinum cardholders that allows you to get exclusive savings on select airlines when you book your airfare through the American Express travel portal.

But it's only valid for international itineraries booked in first class, business class, and premium economy. There are no additional savings here when flying economy.

American Express claims that the average savings are $150 on premium economy, $300 in business class, and $600 on international first-class round trip fares. In practice, we’ve seen these numbers vary depending on the routing, fare class, and the airline.

Read more: Everything You Need to Know About the Amex International Airline Program.

Transfer Membership Rewards Points to Partner Airlines & Hotels

The next – and perhaps best – way to use Membership Rewards points is by transferring them to partner airline and hotel programs. Just like Chase Ultimate Rewards, Citi ThankYou, and even Capital One Venture Miles, you can transfer Amex points directly into your account with certain airlines and hotels.

Read more: Amex Transfer Partners: How & Where to Transfer Membership Rewards Points

Scope out the full list of transfer partners, and you'll see there are plenty of options to send your points.

Membership Rewards Airline Transfer Partners

| Program | Transfer Ratio | Transfer Time |

|---|---|---|

| Aer Lingus | 1:1 | N/A |

| AeroMexico | 1:1.6 | 2-12 days |

| Air Canada Aeroplan | 1:1 | Instant |

| Air France/KLM | 1:1 | Instant |

| Alitalia | 1:1 | Instant |

| ANA | 1:1 | 1-2 days |

| Avianca | 1:1 | Instant |

| British Airways | 1:1 | Instant |

| Cathay Pacific | 1:1 | 1-7 days |

| Delta | 1:1 | Instant |

| El Al | 50:1 | Instant |

| Emirates | 1:1 | Instant |

| Etihad | 1:1 | Instant |

| Hawaiian | 1:1 | Instant |

| Iberia | 1:1 | 1-3 days |

| JetBlue | 1.25:1 | Instant |

| Qantas | 1:1 | Instant |

| Singapore | 1:1 | 12-48 hours |

| Virgin Atlantic | 1:1 | Instant |

As you can see, your Membership Rewards points will transfer to many airlines instantly. That means as soon as you complete the transfer from your Amex account, they should arrive in your airline frequent flyer account.

That said, some transfer partners like Singapore, Cathay Pacific, ANA, Iberia, and more will take anywhere from 12 hours to 12 days.

And while the majority of airline transfer partners will transfer on a 1:1 basis – meaning 1 Amex point will equal 1 airline mile – that's not the case for every one of them.

Membership Rewards Hotel Transfer Partners

On the hotel side of things, you'll have three options. Hilton, Marriott and Choice hotels.

Choice and Marriott will transfer at a ratio of 1:1 while Hilton transfers are a rate of 1:2. That means for every 1 Amex point transferred, you'll receive 2 Hilton Honors points.

| Program | Transfer Ratio | Transfer Time |

|---|---|---|

| Choice Privileges | 1:1 | Instant |

| Hilton Honors | 1:2 | Instant |

| Marriott Bonvoy | 1:1 | Instant |

While it's possible to transfer Amex points to hotels, you'll almost always do better by focusing on transferring points to airlines. In our minds, 50,000 Singapore or ANA miles are worth far more than 50,000 Marriott Bonvoy or Hilton Honors points.

The Best Membership Rewards Points Redemptions

There is no shortage of ways to actually use Membership Rewards points. But not all redemptions are created equal. Depending on how you use them, the value will vary wildly.

For example, you could book a $1,000 flight in economy with 100,000 Amex points by using the Amex travel portal. Or you could transfer just 110,000 points to Virgin Atlantic and use those points to book a first class flight to Tokyo and back on All Nippon Airways that would normally cost $20,000 or more.

Those are two ends of the extreme. Case in point: Travel redemptions like these is where the most value lies.

Rear our post on the 8 Best Ways to Redeem Membership Rewards Points for Maximum Value.

Important Restrictions on Getting American Express Credit Cards

Every bank sets its own rules and restrictions around credit card applications. Chase has the dreaded 5/24 rule, which bars you from getting approved for a new Chase credit card if you’ve opened five or more cards in a 24-month period from any bank – not just Chase.

American Express doesn’t have that same rule, so you don’t need to worry about it when it comes to American Express Membership Rewards credit cards. But that doesn’t mean it’s a free-for-all to get any Amex card you want. Here’s a snippet from the terms of Amex’s card applications:

“Welcome offer not available to applicants who have or have had this or previous versions of this Card. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.”

Essentially that means if you have had a specific American Express card in the past, you will not be eligible to earn the bonus on that same card. Generally, this Amex restriction will follow you for about seven years after you close a card. After that, data points suggest that Amex allows you to apply for that card again – and be eligible to earn the welcome offer bonus, too.

But there's more to it than that. If Amex determines you have a pattern of opening credit cards, earning a bonus, and closing that account afterward, it could make you ineligible to earn a welcome bonus on a new card. So while Amex isn’t looking at your credit card history with other banks, they will factor in which Amex cards you have had previously, and what you have done with the Amex cards you already have … regardless of whether or not you earned the welcome offer bonus on them.

So what does this all mean? You can get all of the Membership Rewards credit cards at least once and earn a big welcome bonus on them.

Watch for the Amex Welcome Offer Pop-Up

These rules may all sound confusing. But the bottom line is that if you think you might be eligible, the best thing to do is try and apply.

Here's why: American Express implemented a tool a few years ago that stops you from submitting an application if you are not eligible for the bonus.

All you need to do is fill out the application as normal and click “Agree and Submit Application.” After a few seconds, if you are not eligible to earn the bonus on that card, American Express will let you know with a pop-up like this:

Better yet, they will give you the chance to cancel your application before pulling your credit score and processing the application. If you don’t receive the pop-up, you should be good to go and eligible to receive the welcome offer bonus on whatever card you are applying for.

Do Amex Membership Rewards Points Expire?

As long as you have an active card that earns Membership Rewards points, your points will never expire. Even if the points you have were earned from a different credit card than you currently have open, you should have nothing to worry about.

But if you decide to cancel a card that earns Membership Rewards, make sure you have a plan for your points. If you only have one card open, canceling that card will immediately forfeit all of your points in your Membership Rewards account.

The best option in this scenario is to transfer your points to one of the airline or hotel partners – or use the points up in a different way – before you close your account.

Related reading: Want to Cancel a Credit Card? Ask Yourself These Questions

Can You Transfer Membership Rewards Points to Other Members?

American Express does not allow points transfers between two different accounts. Whether it's a spouse, family member, or friend, you can't transfer points between two Membership Rewards accounts – even if both users live at the same address.

Instead, you’re allowed to transfer Membership Rewards points directly to another user’s frequent flyer account – so long as that person is an authorized user on your account.

That makes it fairly easy to pool points together to book travel, but it’s still the most restrictive of all the flexible points programs when it comes to this topic. And remember: You can always transfer points into your own airline account and book travel for somebody else.

Read more: Can You Transfer Credit Card Points to Another Person's Account?

Bottom Line

There is a lot to learn about American Express Membership Rewards points.

If you play your cards right, they can be some of the most valuable credit card points out there when it comes time to book cheap travel.

I have a question, if I may. My first AmEx bill since applying and receiving the card will be due in about 2 weeks. Since I received the card, I have spent approximately $2500, but I see no points showing in my account. When do the points actually show in your account? Do they not populate immediately after a transaction posts or is it something along the lines of them not showing up until I pay the bill? I’m confused, because I was under the impression that I would be seeing my points from a purchase show up immediately after that purchase posts onto my account. Please provide some clarity for me. Thank you.

It typically happens after your monthly statement closes.

Great information! Thank you