Having a travel credit card in your wallet is a must when it comes to racking up valuable points and miles to book free (or nearly free) flights. If you're looking to accelerate your travels, there's no better option than the *chase sapphire preferred*.

Whether you plan to stick close to home or travel to far-flung destinations, this card is the perfect option for getting started with points and miles in 2024. Here's why: Chase Ultimate Rewards points are some of the best out there as they provide an unbeatable amount of flexibility to accommodate all kinds of travel goals.. The Sapphire Preferred is particularly useful if you're looking to save on domestic airfare.

With a higher welcome bonus out right now, there's likely no better time to snag this card. Here's the current offer: bonus_miles_full

Let's dive into why the Chase Sapphire Preferred might be the best credit card out there for planning trips in the U.S.

Learn more about the *csp*.

The Basics of the Chase Sapphire Preferred Card

With the current offer you can earn 60,000 Chase Ultimate Rewards points after spending $4,000 within the first three months.

Considering Chase Ultimate Rewards can easily be redeemed through Chase Travel at a rate of 1.25 cents per point, this bonus is worth a bare minimum of $750 towards travel! But you can squeeze far more value out of those points from either card by sending them to Chase's excellent airline and hotel transfer partners – more on that later.

The card also comes with some of the best travel insurance you will find on any credit card, including unparalleled rental car coverage. If you decide to head abroad, you won't need to worry about paying foreign transaction fees when traveling internationally.

Best of all, it has a relatively low annual fee of just $95 each year. And if you play it right, you can easily come out way ahead on that upfront cost.

Read our master guide to earning and burning Chase Ultimate Rewards points!

Plenty of travelers weigh the Chase Sapphire Preferred against co-branded credit cards from their favorite airline. Those airline credit cards can offer some excellent value, with benefits like free checked luggage, priority boarding, and the occasional big welcome bonus. But the average traveler shouldn’t be swiping one of those co-branded credit cards for each and every purchase.

Earning points with one airline can be great until you have to fly with a different airline. At that point, your stash of airline-specific miles doesn't have much value. That's why we encourage readers to quit putting all of their spending on an airline-specific credit card and instead focus on earning transferable points.

That's where the Chase Sapphire Preferred Card shines – and a big part of why we think it is the best card for domestic travel. With a stash of Chase points, you'll be able to use them to book airfare on just about any airline. And when you do, your points will be worth more.

How? Enter Chase Travel℠.

Book Domestic Flights Through Chase Travel℠

Chase's travel booking portal allows you to book flights, hotels, rental cars, cruises, and more with your Chase Ultimate Rewards points. With the Chase Sapphire Preferred Card in your wallet, each point is worth 1.25 cents when booking travel through the portal.

That means the 60,000-point bonus is worth $750 when redeemed through the portal.

Using Chase Travel℠ is simple. Generally speaking, the prices you find for airfare through Chase will match what you will find on Google Flights – our favorite flight booking search engine. And these points can take you quite far: The cheaper the price of your flight, the fewer Chase points you need to use to book.

Since most airlines are available through Chase Travel℠, you don't need to worry about deals popping up on one specific airline if you hold the Sapphire Preferred Card. But don't just take our word for it. Let's take a look at a few examples.

We recently sent a deal to our Thrifty Traveler Premium members for nonstop, roundtrip Delta flights to Denver (DEN) from Minneapolis- St. Paul (MSP) for just $117.

That's a heck of a deal. But it can get even better if you use your Chase points to book. As you can see, that same flight is bookable for $116.95 or only 9,356 Ultimate Rewards points since your points are worth 1.25 cents each ($116.95/0.0125 = 9,356 points).

After meeting the card's minimum spending requirement, you could book six roundtrip tickets to Denver with just one sign-up bonus! Better yet, you'll still earn airline miles when you book through the Chase portal – in this case, Southwest Rapid Rewards points.

Or how about New York City (JFK) to Miami (MIA) for just $91 flying nonstop on American?

Using Chase Travel℠, you could book this ticket for 7,276 points instead.

While this is a great method for booking cheap domestic flights, it's also a great option for international airfare.

Read more: How to Book Flights Through the Chase Travel Portal

Airline Transfer Partners

Another great way to use Chase Ultimate Rewards points is to take advantage of the 11 airlines and three hotel transfer partners. Every Chase point you transfer gets you 1 airline mile or 1 hotel point in that program.

That gives your points immense flexibility that shouldn’t be overlooked. In many cases, sending your points to Chase transfer partners can get you far more value than redeeming them through Chase Travel℠. But you'll have to do the math and see whether utilizing one of these transfer partners or simply booking directly through Chase makes the most sense.

First things first, let's take a look at the list of Chase transfer partners below.

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | Instant |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Emirates | Airline | 1:1 | Instant |

| Iberia Plus | Airline | 1:1 | Instant |

| JetBlue | Airline | 1:1 | Instant |

| Singapore Air | Airline | 1:1 | 12-24 hours |

| Southwest Airlines | Airline | 1:1 | Instant |

| United Airlines | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

| World of Hyatt | Hotel | 1:1 | Instant |

| IHG | Hotel | 1:1 | 1 day |

| Marriott Rewards | Hotel | 1:1 | 2 days |

When it comes to booking domestic flights, transferring your Chase points will give you a lot of options. Transferring points to United or Southwest are obvious choices for domestic travelers – but some additional sweet spots can help you get ahead.

Let's take a look at some of the best workarounds to book flights with legacy carriers like Delta Air Lines, United Airlines, and American Airlines.

Read our complete guide to Chase transfer partners!

Transfer Points to Fly Delta

Thanks to Virgin Atlantic's partnership with Delta, you can book many Delta flights with Virgin Atlantic miles. And since Virgin Atlantic is a transfer partner of Chase Ultimate Rewards, it can be a great way to book domestic flights on Delta.

While Virgin Atlantic has drastically increased the costs to book many Delta flights, shorter domestic Delta flights will still only cost you a few thousand points.

These awards start at just 7,500 points for a one-way redemption up to 500 miles and 11,000 miles for a flight up to 1,000 miles long.

For example, this flight between Minneapolis-St. Paul (MSP) and Chicago O'Hare (ORD) clocks in at less than 500 miles. That means it can be booked for only 7,500 points each way – regardless of the cash price of the flight. And unlike the cheapest award tickets booked with Delta SkyMiles, these awards won't book into basic economy – you'll get a main cabin fare with a free seat assignment.

But you can do even better by turning to Air France and KLM's joint loyalty program, Flying Blue, instead. This same flight can be booked for just 6,500 miles! Award pricing on these short flights booked through Flying Blue can be a bit hit or miss, but scoring a deal like this is a big reason why it's quickly become our favorite workaround for booking Delta flights with points.

You'll also want to compare these redemptions to the cash price, of course – or using your points to book directly through Chase Travel℠. While typically a sneaky workaround, using Virgin Atlantic or Flying Blue to book your Delta flights won't always be the best option. But when cash prices are high, it can provide tremendous value.

Read more: How to Book Award Tickets with Air France/KLM Flying Blue Miles

Transfer to Air Canada, Fly United

For Star Alliance flights, cardholders can transfer their Chase points to Air Canada Aeroplan to book United flights. Though, that's gotten tougher recently as United (and plenty of other airlines) has been limiting the award space they release to partners.

Of course, you could also transfer your points directly to United's MileagePlus program … but you'll typically get far better value out of your points moving them to Air Canada instead.

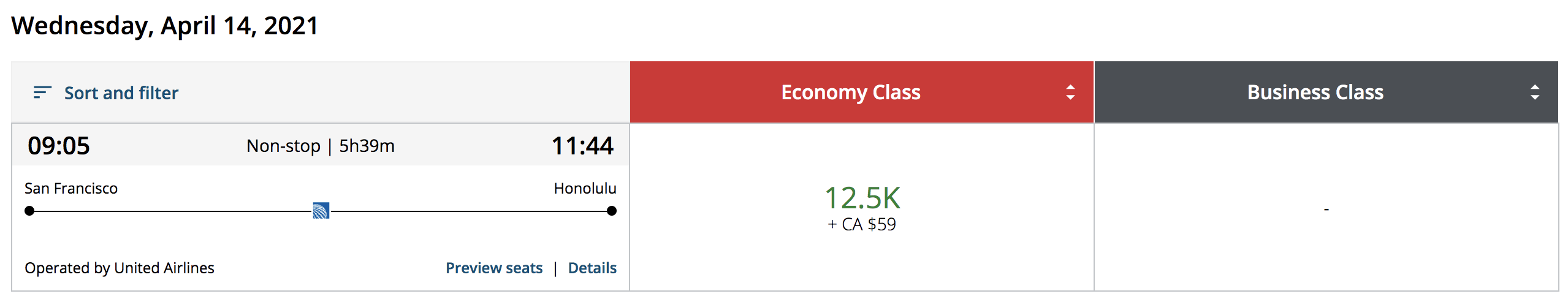

Here's an example: Most airline award charts treat Hawaii separately from the mainland. Not Aeroplan. And that opens a massive sweet spot. Flying out of the West Coast, Aeroplan charges just 12,500 miles in economy – roughly half of what United normally charges for a one-way fare.

United charges over 21,000 miles for the same exact flight.

Considering that trips to the Hawaiian Islands are known to be expensive, being able to fly roundtrip to Hawaii for just 25,000 Aeroplan miles is a bargain. And if you're short on points, Aeroplan provides the flexibility to pay more in cash, which will still help you save significantly on airfare.

Regardless, transferring Chase points to Air Canada Aeroplan is typically a winning move for travelers looking to score a deal.

Read More: How to Book Award Tickets Through Air Canada Aeroplan

Transfer to British Airways, Fly American Airlines

While American Airlines isn't a transfer partner of Chase, there is still a way to book American Airlines flights with Chase points. It's made possible by their partnership with British Airways. And since you can transfer Chase points to British Airways, it can be a solid option for booking flights with American.

Despite a recent award chart change, the airline keeps things simple by charging as few as 12,000 miles for one-way awards. Depending on the distance you're traveling, your flight will be more expensive the further you fly.

Under British Airways' new award pricing, a one-way flight from American Airlines' hub at Dallas-Fort Worth (DFW) to New York City (JFK) now costs 18,000 miles each way.

But since you can transfer Avios freely between all the airlines that use them, you can often do even better than that with the likes of Qatar Airways and Finnair.

If you instead transferred your British Airways Avios to Qatar, you can book this same flight for just 11,000 Avios and an extra $5 in taxes.

Another great option for booking American and Alaska flights for less is the newest airline to adopt Avios as a currency, Finnair. Flights within North America (continental U.S. and Canada) price out at just 11,000 Avios one-way, regardless of the route. And if you've got your sights set on the Hawaiian islands, you'll only need 13,500 one-way in economy, all the way from the mainland.

The only downside with Finnair? You won't find these awards available online. You'll need to use British Airways website to search for availability and then call or chat with Finnair to book. Still, it's a small price to pay for what can be a really significant savings.

Read more: Why You Should Care About Finnair Avios

Bottom Line

The Chase Sapphire Preferred is one of our favorite travel cards, period. But while many travelers focus on piling up Delta SkyMiles or United MileagePlus miles for domestic flights, we think the Chase Sapphire Preferred Card is among the best for domestic travel … no matter your preferred airline.

Chase Ultimate Rewards points offer so much versatility and flexibility. One way or another, you can use the points to book a flight on just about every U.S. airline.

Learn more about the *csp*.

I signed up for the Chase SP card bonus over the summer. How do I know if I am eligible for the $300 in statement credits from the Travel Portal?

Hi Freddy. You won’t be eligible unless you applied for this specific offer in the past month.