Want to travel for free (or nearly free)? You need to be earning flexible points and miles.

The points you earn from travel rewards credit cards give you much more flexibility for booking travel – especially cheap or luxurious travel travel – than any miles you can earn flying with an airline or swiping a co-branded airline credit card. You can book flights or hotels with almost any airline or hotel chain using your points through your bank's travel portal … or you can transfer them to an airline or hotel partner to get even more value out of them.

You know the names of banks that earn these ultra-valuable points: American Express, Capital One, Chase, Citi, Bilt, and more. But two stand out as our favorites in the world of points and miles: Capital One miles vs Chase points.

I'll be honest: There's no clear-cut answer for which is best – that's a personal question. But there are several factors to consider that could lead you to focus more on earning Capital One miles over Chase Ultimate Rewards or vice versa.

Transfer Partners: Capital One vs Chase?

The ability to transfer points to airline or hotel partners to book flights or accommodations for free (or nearly free) is the best way to get the most value for your credit card points. Exactly how much value you can get hinges on your bank's list of transfer partner.

At first glance, Capital One appears superior to Chase based on its sheer number of transfer partners. With Capital One, you can transfer your miles to 15 airlines and three hotel programs. Meanwhile, Chase has just 11 airline and three hotel transfer partners.

But quantity doesn't necessarily mean quality when it comes to these transfer partners. Looking through these lists, you'll see some of the best frequent flyer programs for booking award flights. That opens up different ways to book flights on the three global airline alliances (Oneworld, SkyTeam, and Star Alliance) as well as other independent airlines.

Capital One Airline Transfer Partners

| Program | Ratio | Transfer Time |

|---|---|---|

| Aeromexico | 1:1 | Instant |

| Air Canada Aeroplan | 1:1 | Instant |

| Air France/KLM | 1:1 | Instant |

| Avianca LifeMiles | 1:1 | Instant |

| British Airways | 1:1 | Instant |

| Cathay Pacific AsiaMiles | 1:1 | Up to 5 business days |

| Emirates | 1:1 | Instant |

| Etihad | 1:1 | Up to 1 day |

| EVA Air | 2:1.5 | Up to 5 business days |

| Finnair | 1:1 | Instant |

| Qantas | 1:1 | Instant |

| Singapore | 1:1 | Instant |

| TAP Air Portugal | 1:1 | Same day |

| Turkish Airlines | 1:1 | Same day |

| Virgin Red | 1:1 | Same day |

Capital One Hotel Transfer Partners

| Program | Transfer Ratio | Transfer time |

|---|---|---|

| Accor | 2:1 | Up to 2 business days |

| Wyndham | 1:1 | Same day |

| Choice Hotels | 1:1 | Same day |

Chase Ultimate Rewards Points Airline Transfer Partners

| Program | Transfer Ratio | Transfer Time |

|---|---|---|

| Aer Lingus | 1:1 | Instant |

| Air Canada Aeroplan | 1:1 | Instant |

| Air France/KLM | 1:1 | Instant |

| British Airways | 1:1 | Instant |

| Emirates | 1:1 | Instant |

| Iberia Plus | 1:1 | Instant |

| JetBlue | 1:1 | Instant |

| Singapore Air | 1:1 | 12-24 hours |

| Southwest Airlines | 1:1 | Instant |

| United Airlines | 1:1 | Instant |

| Virgin Atlantic | 1:1 | Instant |

Chase Ultimate Rewards Points Hotel Transfer Partners

| Program | Transfer Ratio | Transfer Time |

|---|---|---|

| World of Hyatt | 1:1 | Instant |

| IHG | 1:1 | 1 day |

| Marriott Rewards | 1:1 | 2 days |

Which Wins? Capital One vs Chase Transfer Partners

Let's break it down a bit.

Capital One and Chase share a handful of transfer partners, including Air Canada Aeroplan, Air France/KLM Flying Blue, British Airways, Emirates, Singapore Airlines, and Virgin Atlantic. Overall, Capital One has a slight edge in that its miles simply transfer to more airlines.

But airline alliances matter, too, and while Chase has fewer airline transfer partners than Capital One, both allow you to transfer your points to British Airways, Virgin Atlantic, and Air Canada to book flights on Oneworld, SkyTeam, and Star Alliance partner airlines, respectively.

With the Oneworld Alliance, Capital One vs Chase largely comes to a draw. Both banks have British Airways at their disposal, which we consider the strongest in the alliance. Using British Airways Avios (or Iberia Avios, for that matter) you can book a round-trip flight to Spain in business class for just 68,000 miles – less than a typical economy award ticket.

Meanwhile, Capital One can also transfer points to Cathay Pacific's Asia Miles program, which, despite a recent devaluation, is still a great option for short-haul travel within Asia and some other valuable (albeit niche) uses.

For SkyTeam, both Capital One and Chase transfer to Virgin Atlantic and Air France/KLM Flying Blue. The latter program is now our go-to way for booking Delta flights for fewer miles.

When it comes to the Star Alliance, Capital One and Chase points both transfer to Air Canada's Aeroplan program – one of the best in the world, period. It charges reasonable rates and low fees to book flights on dozens of airlines. You can even book flights on Etihad (including the Apartments) with Aeroplan miles now, too.

Chase has United as well, which is another solid airline program … but that's it. Capital One miles really shine when it comes to Star Alliance airlines.

You can transfer Capital One miles to both Avianca LifeMiles and Turkish Miles & Smiles: Two of the best Star Alliance programs out there. Even after both mileage programs were hit by devaluations that raised award rates this year, they're still a great option for putting your Capital One miles to use.

If there's one weakness in Capital One's roster of transfer partners, it's hotels. And one hotel transfer partner that could tip this battle in Chase's favor is World of Hyatt.

In the world of hotel points, World of Hyatt reigns supreme. Despite a recent devaluation that raised award rates at hundreds of properties worldwide, it remains far and away the most valuable hotel points program, blowing the likes of Marriott and Hilton out of the water.

Transferring to any of Capital One hotel chain partners won't be a great choice. For Chase, transferring Ultimate Rewards points to Hyatt is one of the best uses of Chase points, period.

That alone can be reason enough for some travelers to give the Capital One miles vs Chase points battle straight to Chase.

Transfer Bonuses

Banks like Chase and Capital One will occasionally offer bonuses when transferring points to an airline or hotel partner, meaning you won't have to transfer as many points as you would normally need to book an award flight. From 10% extra to 30% or more, think of these bonuses as a way to get free airline miles.

When it comes to comparing Capital One vs Chase transfer bonuses, Chase's frequency and broad array of strong transfer partners give it a lead over Capital One. Banks like American Express, Chase, and Citi regularly have transfer bonuses to some of the best frequent flyer programs while Capital One has only offered transfer bonuses only a few times a year.

Capital One Transfer Bonuses

If you're looking to get ahead with Capital One miles by utilizing transfer bonuses, you might as well forget it. Capital One's transfer bonuses are too infrequent compared to what's offered through American Express, Citi, and Chase.

This year, the only worthwhile Capital One transfer bonuses were for Virgin Atlantic in March, Avianca LifeMiles in April and September, and Air France/KLM Flying Blue in September.

Meanwhile, we've seen American Express, Citi, and Chase offer transfer bonuses to some of these same programs several times this year – and often with an even bigger bonus than Capital One. Through Sept. 29, you can get 20% more miles when transferring Capital One miles to Flying Blue.

Chase Transfer Bonuses

The bank offered its first-ever transfer bonus back in April 2019. Ever since, it's been hit or miss.

We sometimes see transfer bonuses from Chase to Virgin Atlantic, Air France/KLM Flying Blue, British Airways, and a few others. A previous 50%

There's no question other banks like American Express still have more frequent and reliable transfer bonuses. However, both banks offer much more than what is available through Capital One.

Points Redemption Options

When it comes to putting Capital One miles and Chase Ultimate Rewards head-to-head, it's important to consider how you'll actually redeem those points for travel. Let's check out some of the best bookings made possible with Capital One miles and Chase points.

The Best Capital One Redemptions

Capital One might have more airline transfer partners than Chase but does not have a valuable hotel partner … at least not on paper. Still, you can get a great deal booking flights using your Capital One miles – with some creative ways to redeem points that you won't find via Chase.

- Book flights (or hotels and other travel experiences) directly through the Capital One Travel portal and save even more with features like price matching and freezing, price alerts, and automatic refunds if the price of your ticket price drops.

- Transfer your points to Air Canada Aeroplan and book an EVA Air business class flight from the U.S. to Asia for just 75,000 points each way.

- Fly Turkish Airlines business class to Istanbul (IST) for 65,000 miles by transferring miles to Turkish.

- Remove any travel purchases such as flights, hotels, Airbnbs, Ubers, or even a bucket list golf trip from your statement with your Capital One miles after the fact.

Read our full guide to earning & burning Capital One miles!

The ability to redeem miles on virtually any travel expense makes Capital One miles incredibly valuable. And for travelers who value the ease of redeeming points above all else, Capital One is king.

The Best Chase Redemptions

Capital One may have Chase beat on transfer partners, but Chase definitely has more transfer bonuses popping up all the time to make your Chase points go even further. There are some stellar ways to redeem your Ultimate Rewards points.

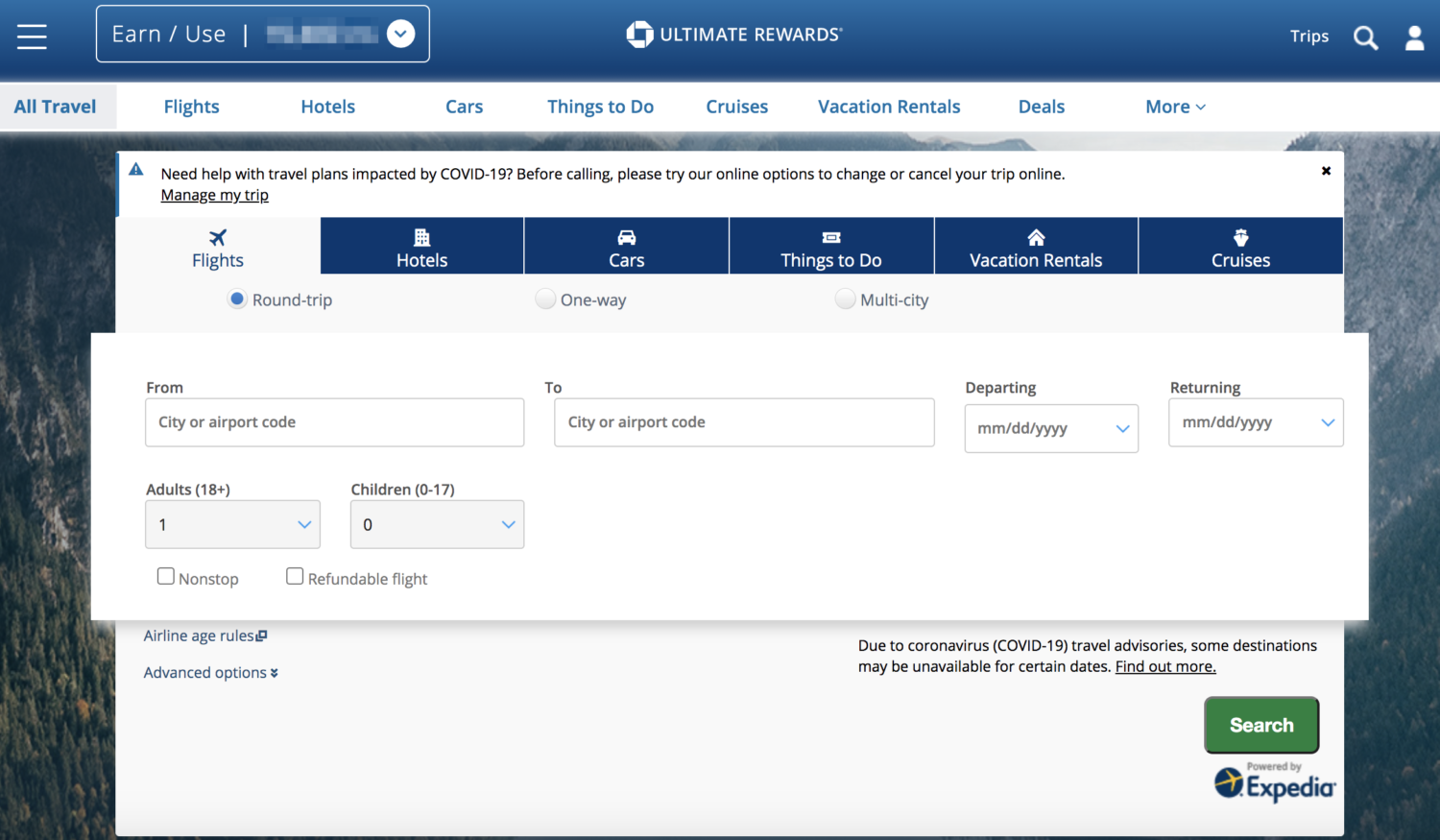

- Book flights (or hotels and other travel expenses) directly through the Chase travel portal to make your Chase points go even further. It's one of the easiest ways to redeem points for travel – and one of the only ways to travel completely free.

- You can fly from the western U.S. to Tokyo and back for just 105,000 Chase points by transferring them to Virgin Atlantic, or 120,000 miles from Chicago-O’Hare (ORD) or East Coast cities.

- Book the world's best business class – Qatar Qsuites – by transferring 70,000 points from Chase to British Airways

- Hyatt is far and away one of the strongest Chase transfer partners. That’s largely because the hotel chain's low award rates make it easy to get an outsized value on amazing hotels worldwide. Check one of our favorite ways to use Hyatt points for all-inclusive resorts!

Read our full guide to earning & burning Chase Ultimate Rewards points!

Lounge Access

Life is not all about points and miles. For frequent fliers, lounge access is perhaps one of the major factors to take into consideration when weighing whether or not to open a travel card in the first place.

The top-tier cards at both banks – *venture x* and *chase sapphire reserve* – are both outstanding for frequent travelers. Both cards come with a free Priority Pass membership to a global network of more than 1,000 airport lounges as well as access to their own branded lounges, although these aren't as widespread yet as, say, American Express' Centurion Lounges.

Capital One Lounges

If you have either the Venture X or *venture x business*, you can get into the Capital One Lounges for free – and bring in two guests.

Currently, there are only three Capital One Lounges open in Denver (DEN), Dallas-Forth Worth (DFW) and Washington D.C.-Dulles (IAD). Additional lounges in Las Vegas (LAS) and New York City (JFK) are also in the works, while the company is also planning dining spaces called Capital One Landings in New York-LaGuardia (LGA) and Washington D.C.-Reagan (DCA). No opening dates have been announced.

Read our guide to Capital One Lounges!

What sets these lounges apart from other airport lounges is the convenient grab-and-go selection of food and drinks you can take with you to your gate, all of which are complimentary.

The Dallas lounge features shower suites, a workout studio with Peloton bikes, wellness rooms, and prayer spaces. The D.C. lounge has a full-service cafe right at the entrance. Love that latte art!

You can add up to four authorized users on your Venture X card for free, and they'll all get their own lounge access, too. It's an easy way to get lounge access for the whole family with just one credit card.

Unlike American Express and Chase, travelers with lower-tier cards like the *capital one venture card* and *CapOne Spark Miles* get two free lounge visits a year (but only through the end of 2024) and a discounted price of $45 for additional visits after that.

There are some restrictions, though. Only flyers presenting a valid boarding pass no more than three hours before their scheduled departure time will be admitted. That also means you won't be able to get into the lounge upon arrival unless you have a connection that departs within that three-hour window – a much stricter policy than lounges like the Amex Centurion Lounges.

Capital One Priority Pass and Other Lounges

To make things even sweeter, Venture X cardholders get access to over 1,400 Priority Pass lounges and over 120 Plaza Premium lounges worldwide.

With the Priority Pass membership through Capital One, you'll also be able to bring in unlimited guests. This incredibly generous access to Priority Pass lounges is perfect for groups and families traveling together.

Unfortunately, Capital One eliminated the dining perk you could previously get at Priority Pass restaurants.

Chase Sapphire Lounges

If you have the Sapphire Reserve card, you can get into Chase Sapphire Lounges for free. There are currently five Chase lounges open: Hong Kong (HKG), Boston (BOS), New York City-LaGuardia (LGA), New York City (JFK), and Washington, D.C.-Dulles (IAD).

Chase plans on opening several more U.S. lounges, including ones in Las Vegas (LAS), Philadelphia (PHL), Phoenix (PHX), San Diego (SAN), and many more locations. In the airport lounge wars, it's safe to say Chase is beating out Capital One handily.

Fit with an upscale vibe and amenities like showers and wellness areas, Chase's emerging lounge network should compete against the likes of American Express and Capital One for years to come.

Sapphire Reserve authorized users all have complimentary access to the Sapphire Lounge once they activate their Priority Pass. The primary cardholder and each authorized user are allowed to bring in two guests.

Just don't expect to be admitted with a Chase Sapphire Preferred card. Want to pay your way in? That will run you $100 per person, per visit.

Much like American Express and Capital One, you will only be admitted within three hours of departure. Luckily, longer layovers may be acceptable.

Chase Priority Pass and Other Lounges

What previously set Chase's top-tier travel rewards card apart from others in the market was the dining credits you got at Priority Pass restaurants. No more.

As of July 1, Sapphire Reserve cardholders no longer receive credits at select airport restaurants via Priority Pass, nor for cafes and markets that are part of Priority Pass.

Still, what remains for cardholders is complimentary Priority Pass Select membership, which gets you the same free access to 1,400-plus airport lounges around the world. You can also bring up to two guests into the lounges with you for free.

Capital One vs Chase Annual Fee: Are the Points Worth It?

With an annual fee of $550, Chase's top-tier premium travel rewards card the Sapphire Reserve, isn't going to be for everyone. Neither is the Capital One Venture X, which comes in at a slightly cheaper (but still hefty) $395 a year.

Before you write off expensive cards like these, hear me out. Do the math to determine whether the benefits you get with each card outweigh those annual fees.

The Capital One Venture X and the Chase Sapphire Reserve both offer an annual $300 travel credit, which greatly offsets the annual fee of either card right off the bat.

On its face, you're getting better value with the Venture X because of the card's lower annual fee. However, the Venture X travel credit can only be used on purchases through the Capital One Travel portal. And the Venture X $300 travel credit, which used to be redeemable as a statement credit after making a purchase through the Capital One Travel portal, is now only redeemable as a discount code at checkout – negating its value somewhat.

The Sapphire Reserve $300 travel credit is more versatile. You'll get a statement credit on any travel purchases you make with your card from flights and hotels to public transportation or ride shares like Uber or Lyft. It's one of the most lucrative benefits on any travel card, period.

That's not all you'll get with these cards, though. Both the Chase Sapphire Reserve and the Capital One Venture X come with a credit that covers the cost of Global Entry or TSA PreCheck, plus a number of other travel perks that could make the annual fee on either card worth it.

Where Chase Reigns Supreme

While we spelled it out while comparing transfer partners, it's worth repeating: Capital One miles are definitely weaker when it comes to hotels. The ability to transfer Chase points to Hyatt alone is a huge plus for Chase. Capital One simply doesn't have a hotel transfer partner that can compete.

Capital One's biggest weakness is one of Chase's greatest strengths. If you plan on making a booking on Capital One's travel portal, every Capital One mile is worth 1 cent toward a flight, hotel, or other travel expenses. That means a stash of 60,000 miles can get you $600 in travel.

When it comes to the battle between Capital One miles vs Chase points, you get more from your points by booking airfare, hotels, and other travel directly through Chase.

With the Sapphire Reserve card, each Chase point is worth 1.5 cents when booking through the Chase Travel portal. So 60,000 Ultimate Rewards would get you $900 in flights or hotels. Even with the Sapphire Preferred card, your points are worth 1.25 cents apiece, meaning 60,000 points would be worth $750 towards travel.

Read our ultimate walkthrough to using the Chase travel portal

This makes Chase one of the best ways to take a cheap flight and make it completely free. And booking flight deals with points is one of our absolute favorite ways to redeem points, as it's easy and you can still earn miles and elite status on these bookings.

Although there are good features to take advantage of with the Capital One Travel portal like price prediction, price watch, and freezing the price of a flight, the value of Capital One miles when booking through the travel portal (or even when covering your travel purchases after the fact) doesn't come close to Chase Ultimate Rewards points.

Earning Points

How to Earn Capital One miles

Now you just need some Capital One miles. You’re in luck. Capital One has a handful of credit cards that earn miles.

Even with a bigger annual fee, we still love the Venture X card. Of course, it doesn't hurt that you can currently earn a huge bonus on the card. You can currently earn 75,000 miles after spending $4,000 within the first three months from account opening.

Read our full review of the Capital One Venture X card!

Learn more about the *venture x*.

There’s also the *capital one venture card*, which is also currently offering an identical 75,000-mile bonus after spending $4,000 within three months. With a $95 annual fee, it's easier to stomach than the $395 you would have to pay for the Venture X – albeit with a fraction of the travel perks.

Similar to the Venture X, the Venture card earns 2x miles for everyday purchases, making this a great choice to maximize your spending without thinking about it.

Learn more about the *capital one venture card*

Read More: Chase Sapphire Preferred vs Capital One Venture Card: Which is Right for You?

How To Earn Chase Points

No matter which side you come down on, it's indisputable: Chase Ultimate Rewards points are incredibly valuable.

And there's one place to start if you want to earn Chase points: It's the *chase sapphire preferred*.

With a big bonus and an annual fee of $95 (which isn’t waived in the first year), it’s tough to beat. There are a handful of other perks, too. That includes 2x points on travel and 3x points per dollar spent on restaurant purchases and no foreign transaction fees.

Read our full review of the Chase Sapphire Preferred Card.

Learn more about the *csp*.

Then there's the *chase sapphire reserve*, the ultra-premium sibling of the Preferred card with tons of travel benefits. But you can’t stack welcome offers by opening both the Chase Sapphire Preferred and Chase Sapphire Reserve – Chase requires you to wait a whopping 48 months after receiving one Sapphire card bonus to be eligible for the other.

Learn more about the *chase sapphire reserve*.

That said, there’s another card that is a perfect complement to the Chase Sapphire Preferred Card. Actually, there are a few.

Enter the Chase Freedom Flex℠ and *freedom unlimited*. These two Chase credit cards have no annual fee and typically earn cash back. But pair one with a Chase Sapphire card, and it forms a powerful tandem that can help you earn even more Chase Ultimate Rewards points on your everyday, ongoing spending.

Read more: How to Transfer Cash Back & Points Between Your Chase Credit Cards

Bottom Line

There are upsides and downsides to each of the two biggest banks in the world of points and miles. Either way, you can't really go wrong.

… but who says you need to choose just one? Really, savvy travelers would be wise to earn points in both programs to fuel their future travels.

Who wins for you in the battle between Capital One vs. Chase?