American Express has been on a roll this year, updating many top travel cards like the Delta SkyMiles co-branded portfolio, Hilton Honors cards, and most recently, the popular Amex Gold Card.

The general theme with these refreshes, as the bank calls them, is all the same: Raising annual fees in exchange for “money-saving” statement credits. The new, Resy dining credit on both the *delta skymiles platinum card* and the *delta reserve card*, as well as the *amex gold card*, is the poster child of this annoying new approach.

On paper, American Express is adding hundreds of dollars in value for cardholders with a bunch of new credits. But in practice, it's turned many of the bank's top travel credit cards into an exercise in “extreme couponing”.

With the Delta Platinum card, you now have up to $120 in statement credits (up to $10 per month), for purchases at U.S. restaurants available through Resy, while the top-tier Delta Reserve card, gets up to $240 in statement credits (up to $20 per month). The non-Delta Amex Gold, meanwhile, gets up to $100 per year in statement credits, broken up into easier-to-use semi-annual chunks of $50 each.

Like many of the credits on other American Express cards like *amex platinum*, these credits are a use-it-or-lose-it benefit. It's up to you to use the credits every month (or six months) … because if you don't, they won't roll over.

If you're diligent, though, you can easily come out ahead. We'll break down everything you need to know about how these new Resy credits – and how you can make the most of them.

What is Resy?

Let's back up and cover the basics, because I'm sure many Amex cardholders had a similar reaction when these new benefits were added: “What's Resy?”

Resy is a restaurant reservation platform available through its website and mobile app. American Express acquired Resy back in 2019, and the bank has slowly been integrating the platform into its cards and services. That's exactly what we're seeing here when this new credit first cropped up on the Delta cards and now more recently, with the Amex Gold.

Restaurants partner with Resy to power their reservations system and other parts of their operation. And there's the rub: Not all restaurants will be available through the platform. And perhaps more importantly, Resy is generally only available in larger metropolitan areas.

While Resy has a big (and growing) presence in cities across the country – as of last year according to Eater, there were more than 16,000 restaurants spread across more than 200 cities globally on Resy – it still skews toward upscale restaurants in big cities like New York City, Chicago, and Los Angeles … and some midsize locations like Austin, Minneapolis, and Portland.

So this new benefit may seem useless to Amex cardholders who live elsewhere. And only U.S. restaurants will qualify for these new credits, so don't count on putting them to use on your international travels, either.

If you don't live in a city with any Resy restaurants, these new card credits will be extremely difficult to use unless you make a plan to put them to use while traveling.

How to Use the New Resy Credits

You'll need to find a Resy partner restaurant and then spend money directly with that restaurant. You're not required to make a reservation through Resy or pay through the app for the credit to work.

Just spend money at any U.S. Resy partner restaurant, and American Express should recognize the charge and issue a statement credit when you make a purchase at one of these restaurants. The statement credit will depend on which Amex card you have.

Here's a look at what each card gets:

- *amex gold card*: You get up to $50 semi-annually (January to June and July to December) in statement credits on eligible purchases with U.S. Resy restaurants.

- *delta reserve card*: You get up to $20 per month in statement credits on eligible purchases with U.S. Resy restaurants.

- *delta skymiles platinum card*: You get up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants.

- *delta reserve business*: You get up to $20 per month in statement credits on eligible purchases with U.S. Resy restaurants.

- *Delta SkyMiles Platinum Biz*: You get up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants.

Keep reading to see how to put your new credit to use.

Enroll for the Benefit in Your Amex Account

First and most importantly, you must log in to your American Express account and enroll in this benefit before putting it to use. Critically, you won't receive any credits until you complete this step.

It's a hoop American Express makes you jump through by design, betting that many cardholders will forget and lose out on these credits. Don't be one of those people – that's exactly what the bank wants.

You can enroll in the benefit by clicking the “Rewards & Benefits” tab once you are in your account. Once you are there, click the “Benefits” tab. Scroll down until you find this new Resy credit, and click “Enroll.”

It's a simple but essential step to take advantage of these statement credits. You just need to do it once – not every time you go to use the benefit.

How to Find Restaurants Where You Can Use the Credit

Once you've enrolled to activate this new credit, you can head to Resy's website or the mobile app to find participating restaurants.

Both the website and mobile app are location-based, so you'll be able to quickly see partner restaurants in your area. Since I'm located in the Minneapolis – St. Paul area, I can quickly see all of the eligible restaurants near me.

Again, you don't actually have to pay or make a reservation directly through Resy. Just dine at one of the partner restaurants and pay with your eligible Amex card and the credit should kick in automatically.

If you are in a large metropolitan area, you should have plenty of options available. At the top of Resy's website, you can see a list of popular cities in the U.S. and abroad. But Remember: This new Resy credit can only be used at U.S. restaurants.

You can search for a city to see what options are available. Fair warning: If you live in a smaller city, you either won't have any Resy partner restaurants available or the selection will be minimal, making these credits much harder to use.

So long as you enrolled in the benefit through your Amex account, you dine at an eligible Resy restaurant, and you pay the bill with either your eligible Amex card, you should receive the credit within a few days of making the transaction.

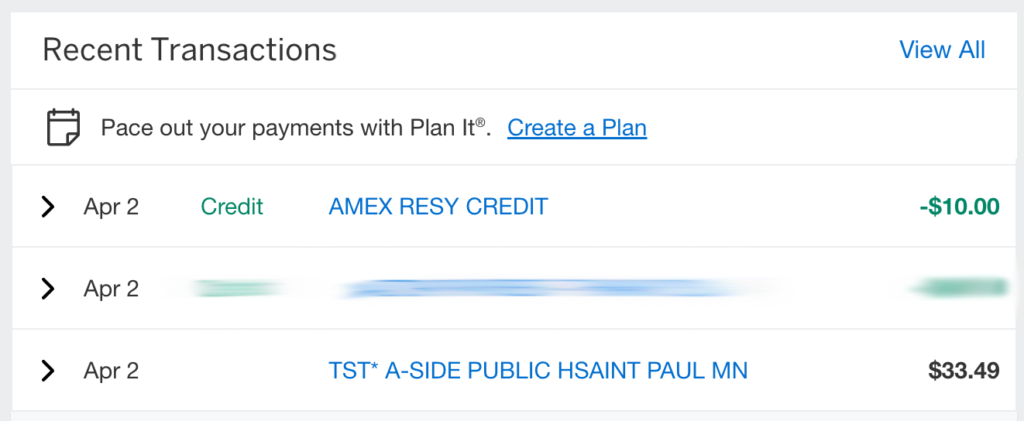

American Express officially says that the statement credits could take six to eight weeks to post to your account, but most data points suggest the credit will kick in within a few business days. That was our experience using the credit as well. It officially posted a few days after making the purchase at a Resy restaurant.

Can You Buy Resy Restaurant Gift Cards Instead?

As these credits have spread to more cards in Amex's lineup, we had a question: Could you just buy a gift card at a partner restaurant to use the credit instead?

No question, that would make the monthly credit on the Delta cards infinitely more useful – and even the Amex Gold Card's credit, too. Rather than dining out at a Resy restaurant, you could buy a gift card and then use them all at once later on. We decided to try it out at Dario, a new Italian restaurant in Minneapolis and a Resy partner.

Dario sells gift cards on its website, so we went ahead and bought one for $10 to test this out, hoping it would trigger the new $10 credit on a Delta Platinum card. Sure enough, a few days later the statement credit posted as we hoped.

We're reasonably sure that this would also work for in-person gift card purchases at Resy partner restaurants. While the benefit terms state that non-dining purchases such as merchandise or gift cards may not be eligible for the new credit, that would require the restaurant to process those transactions differently than a regular dining purchase – and that's typically not the case. So long as it isn't a third-party selling you the gift card, you should be good to go.

Fair warning: This may vary from restaurant to restaurant, particularly at locations that don't sell physical gift cards. But it's always worth a shot!

Bottom Line

Among the many new benefits American Express has introduced as part of its product “refreshes” is a statement credit to be used at Resy restaurants in the U.S. Delta Platinum and Reserve cardholders now have $10 or $20 a month, respectively, to put toward Resy restaurants, while Amex Gold Cardholders get $50 semi-annually.

Like many other Amex credits, these new Resy restaurant credits are use-them-or-lose-them perks that don't roll over from month to month. It's up to you head to a participating U.S. restaurant to put them to use.

Just be sure to enroll in this benefit before you do. After that, you're all set.

At Mauna Lani resort on the Big Island of Hawaii the superb and very popular Napua restaurant is a qualifying restaurant.

I made a reservation at Kona Grill March 29. I checked in at host stand and asked to sit at the bar.

I paid with Delta Reserve and received the $20 credit on March 31.

Still waiting for credit. Lyft credits come through within a day. Resy taking weeks, and still haven’t seen any credits for Resy. Going to be a hassle trying to keep track if the credit ever posts……

I have only been able to fine the apple resy app, I need the android version.

More cons: the resy website search is pathetic, and there is no android app.

It’s also unclear to what extent takeout works. I tried it, and didn’t get a credit, but who knows, since they said it could take two to three years for the credits to appear. What a huge PITA. Along with the hike in AF, it sure looks destined for cancelation.

The number of restaurants on Resy in my area was not large but one of my favorite restaurants was on there, so I booked it. The restaurant charge and the credit were on the same statement, so that worked out well.

I used my Delta Platinum at a Resy restaurant in Minneapolis on March 10 and still no credit. The website says it can take 6-8 weeks to show up, which isn’t very helpful when you only have 1 month to spend before the credit is gone.

I love in Lexington, KY. This is an absolutely worthless benefit.

Amex and Delta have been advertising it so much but its so hard to find resy restaurant options around.

Between my wife and I we have three Delta reserve cards (one for business) though will probably drop one when the fee comes due.

Went to one restaurant last month and put charges on all 3 cards though still waiting on credit.

It always boggles my mind that each member of the family has to have their own Reserve Card for each member to have their own benefits. At 550 a year, my husband should not have to have his own Reserve Card, (not just an authorized user card off of my account) so that he could also enjoy these benefits when he flies without me